Page 10 - FIN435 RHB vs BPMB

P. 10

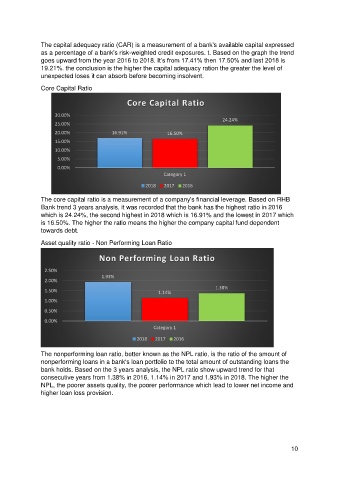

The capital adequacy ratio (CAR) is a measurement of a bank's available capital expressed

as a percentage of a bank's risk-weighted credit exposures. t. Based on the graph the trend

goes upward from the year 2016 to 2018. It’s from 17.41% then 17.50% and last 2018 is

19.21%. the conclusion is the higher the capital adequacy ration the greater the level of

unexpected loses it can absorb before becoming insolvent.

Core Capital Ratio

Core Capital Ratio

30.00%

24.24%

25.00%

20.00% 16.91% 16.50%

15.00%

10.00%

5.00%

0.00%

Category 1

2018 2017 2016

The core capital ratio is a measurement of a company's financial leverage. Based on RHB

Bank trend 3 years analysis, it was recorded that the bank has the highest ratio in 2016

which is 24.24%, the second highest in 2018 which is 16.91% and the lowest in 2017 which

is 16.50%. The higher the ratio means the higher the company capital fund dependent

towards debt.

Asset quality ratio - Non Performing Loan Ratio

Non Performing Loan Ratio

2.50%

1.93%

2.00%

1.38%

1.50% 1.14%

1.00%

0.50%

0.00%

Category 1

2018 2017 2016

The nonperforming loan ratio, better known as the NPL ratio, is the ratio of the amount of

nonperforming loans in a bank's loan portfolio to the total amount of outstanding loans the

bank holds. Based on the 3 years analysis, the NPL ratio show upward trend for that

consecutive years from 1.38% in 2016, 1.14% in 2017 and 1.93% in 2018. The higher the

NPL, the poorer assets quality, the poorer performance which lead to lower net income and

higher loan loss provision.

10