Page 7 - FIN435 RHB vs BPMB

P. 7

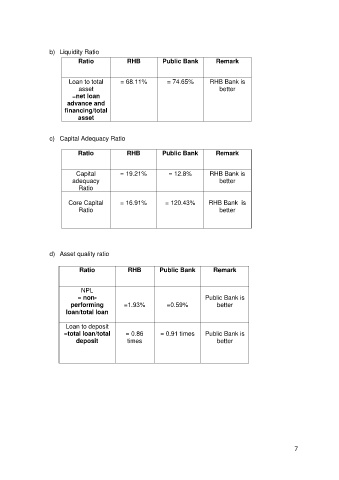

b) Liquidity Ratio

Ratio RHB Public Bank Remark

Loan to total = 68.11% = 74.65% RHB Bank is

asset better

=net loan

advance and

financing/total

asset

c) Capital Adequacy Ratio

Ratio RHB Public Bank Remark

Capital = 19.21% = 12.8% RHB Bank is

adequacy better

Ratio

Core Capital = 16.91% = 120.43% RHB Bank is

Ratio better

d) Asset quality ratio

Ratio RHB Public Bank Remark

NPL

= non- Public Bank is

performing =1.93% =0.59% better

loan/total loan

Loan to deposit

=total loan/total = 0.86 = 0.91 times Public Bank is

deposit times better

7