Page 5 - FIN435 RHB vs BPMB

P. 5

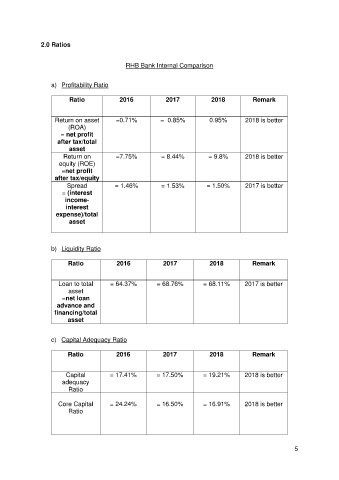

2.0 Ratios

RHB Bank Internal Comparison

a) Profitability Ratio

Ratio 2016 2017 2018 Remark

Return on asset =0.71% = 0.85% 0.95% 2018 is better

(ROA)

= net profit

after tax/total

asset

Return on =7.75% = 8.44% = 9.8% 2018 is better

equity (ROE)

=net profit

after tax/equity

Spread = 1.46% = 1.53% = 1.50% 2017 is better

= (interest

income-

interest

expense)/total

asset

b) Liquidity Ratio

Ratio 2016 2017 2018 Remark

Loan to total = 64.37% = 68.76% = 68.11% 2017 is better

asset

=net loan

advance and

financing/total

asset

c) Capital Adequacy Ratio

Ratio 2016 2017 2018 Remark

Capital = 17.41% = 17.50% = 19.21% 2018 is better

adequacy

Ratio

Core Capital = 24.24% = 16.50% = 16.91% 2018 is better

Ratio

5