Page 15 - The Great 401k Rip-Off

P. 15

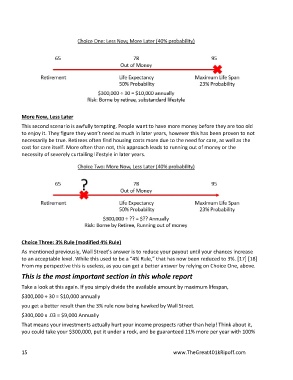

More Now, Less Later

This second scenario is awfully tempting. People want to have more money before they are too old

to enjoy it. They figure they won’t need as much in later years, however this has been proven to not

necessarily be true. Retirees often find housing costs more due to the need for care, as well as the

cost for care itself. More often than not, this approach leads to running out of money or the

necessity of severely curtailing lifestyle in later years.

Choice Three: 3% Rule (modified 4% Rule)

As mentioned previously, Wall Street’s answer is to reduce your payout until your chances increase

to an acceptable level. While this used to be a “4% Rule,” that has now been reduced to 3%. [17] [18]

From my perspective this is useless, as you can get a better answer by relying on Choice One, above.

This is the most important section in this whole report

Take a look at this again. If you simply divide the available amount by maximum lifespan,

$300,000 ÷ 30 = $10,000 annually

you get a better result than the 3% rule now being hawked by Wall Street.

$300,000 x .03 = $9,000 Annually

That means your investments actually hurt your income prospects rather than help! Think about it,

you could take your $300,000, put it under a rock, and be guaranteed 11% more per year with 100%

15 www.TheGreat401kRipoff.com