Page 16 - The Great 401k Rip-Off

P. 16

certainty. Of course, that does not include an inflation hedge, which the 3% Rule does, but still, the

Wall Street Model reduces your chances of success to 90% rather than 100%.

Blast from the Past

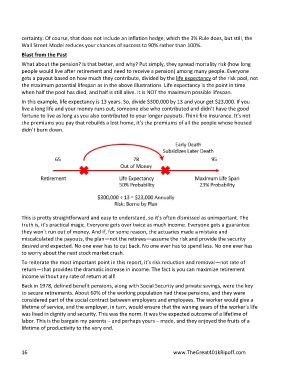

What about the pension? Is that better, and why? Put simply, they spread mortality risk (how long

people would live after retirement and need to receive a pension) among many people. Everyone

gets a payout based on how much they contribute, divided by the life expectancy of the risk pool, not

the maximum potential lifespan as in the above illustrations. Life expectancy is the point in time

when half the pool has died, and half is still alive. It is NOT the maximum possible lifespan.

In this example, life expectancy is 13 years. So, divide $300,000 by 13 and your get $23,000. If you

live a long life and your money runs out, someone else who contributed and didn’t have the good

fortune to live as long as you also contributed to your longer payouts. Think fire insurance. It’s not

the premiums you pay that rebuilds a lost home, it’s the premiums of all the people whose housed

didn’t burn down.

This is pretty straightforward and easy to understand, so it’s often dismissed as unimportant. The

truth is, it’s practical magic. Everyone gets over twice as much income. Everyone gets a guarantee

they won’t run out of money. And if, for some reason, the actuaries made a mistake and

miscalculated the payouts, the plan—not the retirees—assume the risk and provide the security

desired and expected. No one ever has to cut back. No one ever has to spend less. No one ever has

to worry about the next stock market crash.

To reiterate the most important point in this report, it’s risk reduction and removal—not rate of

return—that provides the dramatic increase in income. The fact is you can maximize retirement

income without any rate of return at all!

Back in 1978, defined benefit pensions, along with Social Security and private savings, were the key

to secure retirements. About 60% of the working population had these pensions, and they were

considered part of the social contract between employers and employees. The worker would give a

lifetime of service, and the employer, in turn, would ensure that the waning years of the worker’s life

was lived in dignity and security. This was the norm. It was the expected outcome of a lifetime of

labor. This is the bargain my parents – and perhaps yours – made, and they enjoyed the fruits of a

lifetime of productivity to the very end.

16 www.TheGreat401kRipoff.com