Page 9 - The Great 401k Rip-Off

P. 9

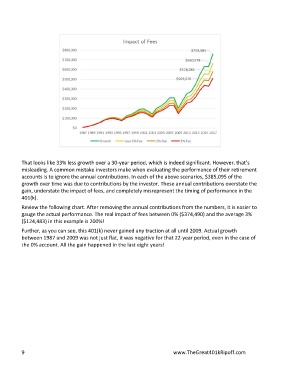

That looks like 33% less growth over a 30‐year period, which is indeed significant. However, that’s

misleading. A common mistake investors make when evaluating the performance of their retirement

accounts is to ignore the annual contributions. In each of the above scenarios, $385,095 of the

growth over time was due to contributions by the investor. These annual contributions overstate the

gain, understate the impact of fees, and completely misrepresent the timing of performance in the

401(k).

Review the following chart. After removing the annual contributions from the numbers, it is easier to

gauge the actual performance. The real impact of fees between 0% ($374,490) and the average 3%

($124,483) in this example is 200%!

Further, as you can see, this 401(k) never gained any traction at all until 2009. Actual growth

between 1987 and 2009 was not just flat, it was negative for that 22‐year period, even in the case of

the 0% account. All the gain happened in the last eight years!

9 www.TheGreat401kRipoff.com