Page 66 - The Informed Fed--Hearn (edited 10.29.20)

P. 66

A common misconception is that your spouse has to be enrolled for

five years prior to your retirement. This is not true. As long as your

spouse has other coverage, they can enroll in your plan either after a life-

changing event or during any open season. A pitfall to avoid here is that

if your spouse continues to work after you retire and keeps their own

health coverage thinking they’ll get on your plan when they retire, and

then the federal retiree passes away before the spouse has a chance to

retire. The spouse loses the access to those health benefits because they

were not covered by the FEHB at the time of the retiree’s passing. Even

if you take the survivor benefit to enable your spouse to continue health

benefits if you pass away first, and if the spouse is not covered by FEHB

on the day you die, they are unable to get FEHB coverage. Your overall

health care expenses include more than just your share of the premium.

You also have to take into consideration what your maximum

deductibles could be, as well as any co-pays for doctors, hospitalization

and prescriptions. In the case of the High-Deductible Health Plan, you

also get a rebate from the insurance company, so you get to deduct that

amount from your overall expenses.

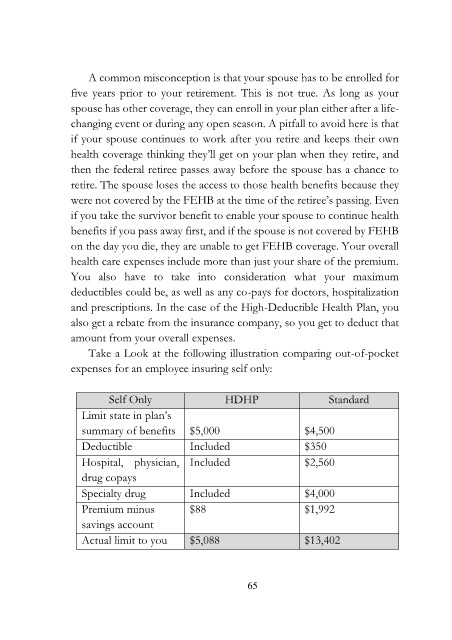

Take a Look at the following illustration comparing out-of-pocket

expenses for an employee insuring self only:

Self Only HDHP Standard

Limit state in plan’s

summary of benefits $5,000 $4,500

Deductible Included $350

Hospital, physician, Included $2,560

drug copays

Specialty drug Included $4,000

Premium minus $88 $1,992

savings account

Actual limit to you $5,088 $13,402

65