Page 119 - sampelcetak

P. 119

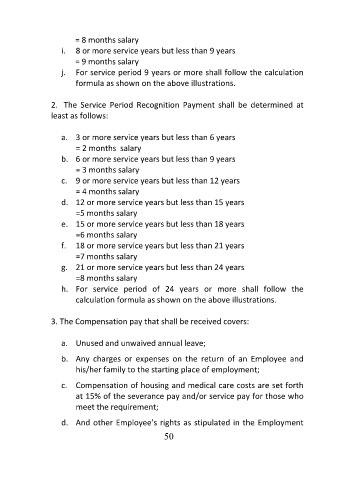

= 8 months salary

i. 8 or more service years but less than 9 years

= 9 months salary

j. For service period 9 years or more shall follow the calculation

formula as shown on the above illustrations.

2. The Service Period Recognition Payment shall be determined at

least as follows:

a. 3 or more service years but less than 6 years

= 2 months salary

b. 6 or more service years but less than 9 years

= 3 months salary

c. 9 or more service years but less than 12 years

= 4 months salary

d. 12 or more service years but less than 15 years

=5 months salary

e. 15 or more service years but less than 18 years

=6 months salary

f. 18 or more service years but less than 21 years

=7 months salary

g. 21 or more service years but less than 24 years

=8 months salary

h. For service period of 24 years or more shall follow the

calculation formula as shown on the above illustrations.

3. The Compensation pay that shall be received covers:

a. Unused and unwaived annual leave;

b. Any charges or expenses on the return of an Employee and

his/her family to the starting place of employment;

c. Compensation of housing and medical care costs are set forth

at 15% of the severance pay and/or service pay for those who

meet the requirement;

d. And other Employee’s rights as stipulated in the Employment

50