Page 23 - Mumme Booklet

P. 23

DRAFT

DOUG AND MARIE MUMME

COMPARISON OF SAVINGS ALTERNATIVES FOR

RETIREMENT

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

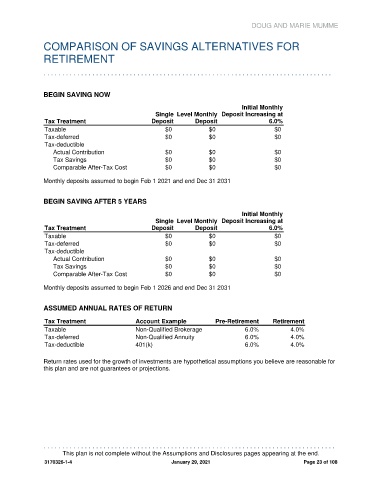

BEGIN SAVING NOW

Initial Monthly

Single Level Monthly Deposit Increasing at

Tax Treatment Deposit Deposit 6.0%

Taxable $0 $0 $0

Tax-deferred $0 $0 $0

Tax-deductible

Actual Contribution $0 $0 $0

Tax Savings $0 $0 $0

Comparable After-Tax Cost $0 $0 $0

Monthly deposits assumed to begin Feb 1 2021 and end Dec 31 2031

BEGIN SAVING AFTER 5 YEARS

Initial Monthly

Single Level Monthly Deposit Increasing at

Tax Treatment Deposit Deposit 6.0%

Taxable $0 $0 $0

Tax-deferred $0 $0 $0

Tax-deductible

Actual Contribution $0 $0 $0

Tax Savings $0 $0 $0

Comparable After-Tax Cost $0 $0 $0

Monthly deposits assumed to begin Feb 1 2026 and end Dec 31 2031

ASSUMED ANNUAL RATES OF RETURN

Tax Treatment Account Example Pre-Retirement Retirement

Taxable Non-Qualified Brokerage 6.0% 4.0%

Tax-deferred Non-Qualified Annuity 6.0% 4.0%

Tax-deductible 401(k) 6.0% 4.0%

Return rates used for the growth of investments are hypothetical assumptions you believe are reasonable for

this plan and are not guarantees or projections.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 23 of 108