Page 24 - Mumme Booklet

P. 24

DRAFT

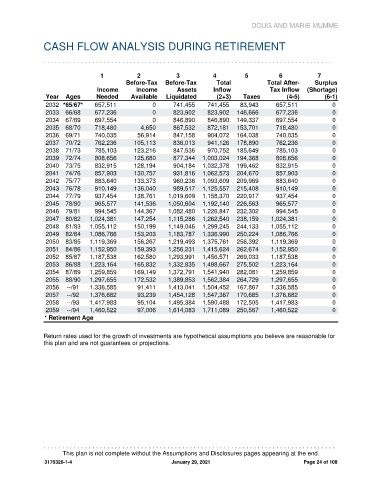

DOUG AND MARIE MUMME

CASH FLOW ANALYSIS DURING RETIREMENT

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7

Before-Tax Before-Tax Total Total After- Surplus

Income Income Assets Inflow Tax Inflow (Shortage)

Year Ages Needed Available Liquidated (2+3) Taxes (4-5) (6-1)

2032 *65/67* 657,511 0 741,455 741,455 83,943 657,511 0

2033 66/68 677,236 0 823,902 823,902 146,666 677,236 0

2034 67/69 697,554 0 846,890 846,890 149,337 697,554 0

2035 68/70 718,480 4,650 867,532 872,181 153,701 718,480 0

2036 69/71 740,035 56,914 847,158 904,072 164,038 740,035 0

2037 70/72 762,236 105,113 836,013 941,126 178,890 762,236 0

2038 71/73 785,103 123,216 847,536 970,752 185,649 785,103 0

2039 72/74 808,656 125,680 877,344 1,003,024 194,368 808,656 0

2040 73/75 832,915 128,194 904,184 1,032,378 199,462 832,915 0

2041 74/76 857,903 130,757 931,816 1,062,573 204,670 857,903 0

2042 75/77 883,640 133,373 960,236 1,093,609 209,969 883,640 0

2043 76/78 910,149 136,040 989,517 1,125,557 215,408 910,149 0

2044 77/79 937,454 138,761 1,019,609 1,158,370 220,917 937,454 0

2045 78/80 965,577 141,536 1,050,604 1,192,140 226,563 965,577 0

2046 79/81 994,545 144,367 1,082,480 1,226,847 232,302 994,545 0

2047 80/82 1,024,381 147,254 1,115,286 1,262,540 238,159 1,024,381 0

2048 81/83 1,055,112 150,199 1,149,046 1,299,245 244,133 1,055,112 0

2049 82/84 1,086,766 153,203 1,183,787 1,336,990 250,224 1,086,766 0

2050 83/85 1,119,369 156,267 1,219,493 1,375,761 256,392 1,119,369 0

2051 84/86 1,152,950 159,393 1,256,231 1,415,624 262,674 1,152,950 0

2052 85/87 1,187,538 162,580 1,293,991 1,456,571 269,033 1,187,538 0

2053 86/88 1,223,164 165,832 1,332,835 1,498,667 275,502 1,223,164 0

2054 87/89 1,259,859 169,149 1,372,791 1,541,940 282,081 1,259,859 0

2055 88/90 1,297,655 172,532 1,389,853 1,562,384 264,729 1,297,655 0

2056 --/91 1,336,585 91,411 1,413,041 1,504,452 167,867 1,336,585 0

2057 --/92 1,376,682 93,239 1,454,128 1,547,367 170,685 1,376,682 0

2058 --/93 1,417,983 95,104 1,495,384 1,590,488 172,505 1,417,983 0

2059 --/94 1,460,522 97,006 1,614,083 1,711,089 250,567 1,460,522 0

* Retirement Age

Return rates used for the growth of investments are hypothetical assumptions you believe are reasonable for

this plan and are not guarantees or projections.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 24 of 108