Page 16 - Obligatory Zakat Made Easy

P. 16

Definition

Gold is a type of metal for which the owner is obliged to

pay zakat. The obligation of zakat on gold is described by iii. Sharia Compliant Gold Investment

Allah (SWT): Physical Gold

Physically owned gold is usually intended as an

"And there are those who bury gold and silver and spend it investment to earn profit. Usually the gold is in the form

not in the way of Allah: announce unto them a most of coins, ingots, bars and wafers. Zakat must be paid if

grievous penalty. On the Day when heat will be produced the weight of gold equals to or exceeds the nisab of 85

out of that (wealth) in the fire of Hell, and with it will be grams.

branded their foreheads, their flanks and their backs "This

is the (treasure) which ye buried for yourselves: taste ye, Calculation Example

then the (treasures) ye buried!"

At Taubah: Verses 34-35 Weight of gold x Current price of x 2.5%

= 400 grams x RM180,000.00 x 2.5%

Calculation Method = RM72,000.00 X 2.5%

(Note?)

= RM1,800.00

i. Unused Jewellery Gold (Not Worn)

Jewellery gold that is not used or worn even once

during a year is considered unused gold. If the value of

the gold equals to or exceeds the nisab of 85 grams, it

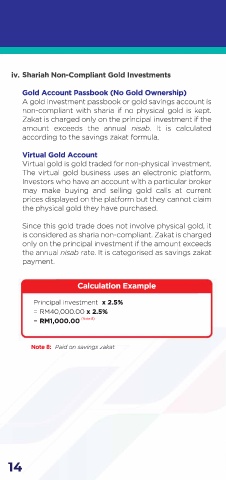

is obligatory to pay zakat with a rate of 2.5% of the Gold Account Passbook (With Gold Ownership)

total gold value.

There are banks offering gold investments passbook or a

Calculation Example gold savings account. This account does not record the

savings amount in ringgit value but in grams of gold units.

Weight of unused gold x Current price of 1 gram of

gold x 2.5% Sharia compliance occurs when physical gold exists and is

= 100 grams x RM180.00 x 2.5% held by investors. Zakat is required if there is an

= RM18,000.00 x 2.5% investment intention and the gold weight reaches the

= RM450.00

nisab of 85 grams.

ii. Worn Jewellery Gold Calculation Example

Jewellery gold that is worn for the purpose of Weight of gold x Current price of x 2.5%

self-adornment is not subject to zakat, but if it exceeds = 200 grams x RM180,00.00 x 2.5%

the uruf, zakat will be imposed. Uruf is the local = RM36,000.00 x 2.5%

practice of wearing jewellery gold. The uruf rate in the = RM900.00 (Note?)

Federal Territory is 800 grams. The zakat rate is 2.5%.

Calculation Example

Note 7: Paid on business zakat

Weight of worn jewellery gold x Current price of

1 gram of gold x 2.5%

= 900 grams x RM180.00 x 2.5%

= RM162,000.00 X 2.5%

= RM4,050.00

12 13