Page 18 - Obligatory Zakat Made Easy

P. 18

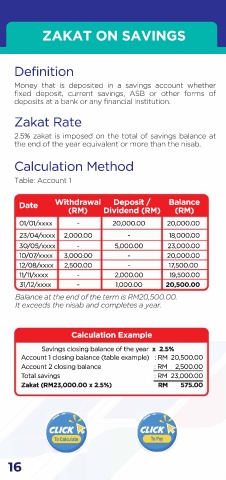

Definition

iv. Shariah Non-Compliant Gold Investments

Gold Account Passbook (No Gold Ownership) For silver, whether used as jewellery or stored as

A gold investment passbook or gold savings account is ornaments within a year & exceeding the nisab, the

calculation is based on the value of the silver object. Nisab

non-compliant with sharia if no physical gold is kept. for silver equals to or exceeds 595 grams. The zakat rate is

Zakat is charged only on the principal investment if the 2.5%.

amount exceeds the annual nisab. It is calculated

according to the savings zakat formula. "And there are those who bury gold and silver and spend it

not in the way of Allah: announce unto them a most

Virtual Gold Account grievous penalty. On the Day when heat will be produced

Virtual gold is gold traded for non-physical investment. out of that (wealth) in the fire of Hell, and with it will be

The virtual gold business uses an electronic platform. branded their foreheads, their flanks and their backs"This is

Investors who have an account with a particular broker the (treasure) which ye buried for yourselves: taste ye, then

may make buying and selling gold calls at current the (treasures) ye buried!" At-Taubah: Verses 34-35

prices displayed on the platform but they cannot claim

the physical gold they have purchased.

Since this gold trade does not involve physical gold, it

is considered as sharia non-compliant. Zakat is charged Calculation Method

only on the principal investment if the amount exceeds

the annual nisab rate. It is categorised as savings zakat

payment. Calculation Example

Weight of silver x Current price of 1 gram of silver x 2.5%

Calculation Example = 1,000 grams x RM2.36 x 2.5%

= RM2,360.00 X 2.5%

Principal investment x 2.5% = RM59.00

= RM40,000.00 x 2.5%

= RM1,000.00 (NoteB)

Note 8: Paid on savings zakat

14 15