Page 9 - Obligatory Zakat Made Easy

P. 9

Definition

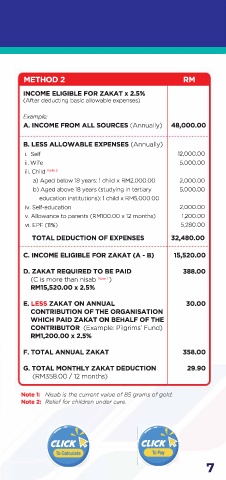

METHOD2 RM

According to Prof. Dr Yusuf AI-Qaradhawi and Dr Hussein

Shahatah, salary and income zakat are called al-Mal INCOME ELIGIBLE FOR ZAKAT x 2.5%

al-Mustafad, i.e. zakat which is derived from salary and (After deducting basic allowable expenses)

professional income.

Example:

A. INCOME FROM ALL SOURCES (Annually) 48,000.00

Categories of Salary and Income

B. LESS ALLOWABLE EXPENSES (Annually)

i. Employment Salary and Wages: Salaries, wages, i. Self 12,000.00

bonuses, overtime pay, gratuity, compensation, ii. Wife 5,000.00

pensions, prizes, awards, intensive, ESOS (employee iii. Child Note2

stock option scheme) and any income derived from a) Aged below 18 years: 1 child x RM2,000.00 2,000.00

service or employment. b) Aged above 18 years (studying in tertiary 5,000.00

education institutions): 1 child x RMS,000.00

ii. Freelance Income iv. Self-education 2,000.00

• Payment of professional consultancy services v. Allowance to parents (RMl00.00 x 12 months) 1,200.00

• Project payments or profits received by contractors vi. EPF (11%) 5,280.00

• Commission and residual income such as sales of TOTAL DEDUCTION OF EXPENSES 32,480.00

insurance, takaful, unit trust, brokerage & the like

• Royalties or commissions from writing, publications, C. INCOME ELIGIBLE FOR ZAKAT (A - B) 15,520.00

arts activities and so on

D. ZAKAT REQUIRED TO BE PAID 388.00

(C is more than nisab Notel )

iii. Income-Generating Property (Mustaghallat) RMlS,520.00 x 2.5%

• Rental income from assets such as buildings,

premises, equipment, etc. E. LESS ZAKAT ON ANNUAL 30.00

• Products of livestock such as milk, eggs, honey, etc. CONTRIBUTION OF THE ORGANISATION

WHICH PAID ZAKAT ON BEHALF OF THE

* Income not required for zakat calculation: CONTRIBUTOR (Example: Pilgrims' Fund)

Claims of lodging, overseas travel, entertainment, mileage RMl,200.00 x 2.5%

and other

F. TOTAL ANNUAL ZAKAT 358.00

Calculation Method G. TOTAL MONTHLY ZAKAT DEDUCTION 29.90

(RM358.00 / 12 months)

METHOD 1 RM Note 1: Nisab is the current value of 85 grams of gold.

ANNUAL GROSS INCOME 48,000.00 Note 2: Relief for children under care.

(Due to exceeding the nisab Noce, ) x 2.5%

ZAKAT REQUIRED TO BE PAID 1,200.00

6 7