Page 42 - NCCAA Finance Board Accountability

P. 42

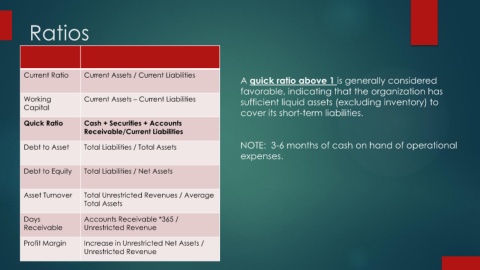

Ratios

Current Ratio Current Assets / Current Liabilities

A quick ratio above 1 is generally considered

favorable, indicating that the organization has

Working Current Assets – Current Liabilities sufficient liquid assets (excluding inventory) to

Capital

cover its short-term liabilities.

Quick Ratio Cash + Securities + Accounts

Receivable/Current Liabilities

Debt to Asset Total Liabilities / Total Assets NOTE: 3-6 months of cash on hand of operational

expenses.

Debt to Equity Total Liabilities / Net Assets

Asset Turnover Total Unrestricted Revenues / Average

Total Assets

Days Accounts Receivable *365 /

Receivable Unrestricted Revenue

Profit Margin Increase in Unrestricted Net Assets /

Unrestricted Revenue