Page 44 - NCCAA Finance Board Accountability

P. 44

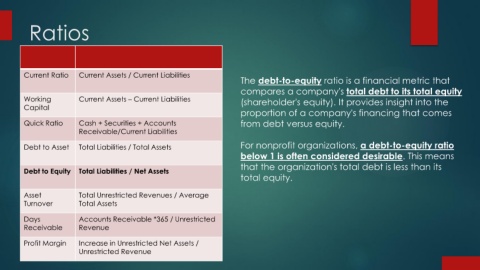

Ratios

Current Ratio Current Assets / Current Liabilities

The debt-to-equity ratio is a financial metric that

compares a company's total debt to its total equity

Working Current Assets – Current Liabilities (shareholder's equity). It provides insight into the

Capital

proportion of a company's financing that comes

Quick Ratio Cash + Securities + Accounts from debt versus equity.

Receivable/Current Liabilities

Debt to Asset Total Liabilities / Total Assets For nonprofit organizations, a debt-to-equity ratio

below 1 is often considered desirable. This means

that the organization's total debt is less than its

Debt to Equity Total Liabilities / Net Assets

total equity.

Asset Total Unrestricted Revenues / Average

Turnover Total Assets

Days Accounts Receivable *365 / Unrestricted

Receivable Revenue

Profit Margin Increase in Unrestricted Net Assets /

Unrestricted Revenue