Page 46 - NCCAA Finance Board Accountability

P. 46

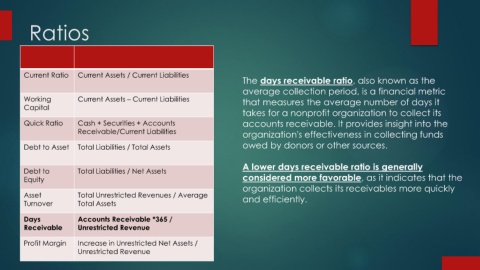

Ratios

Current Ratio Current Assets / Current Liabilities

The days receivable ratio, also known as the

average collection period, is a financial metric

Working Current Assets – Current Liabilities that measures the average number of days it

Capital

takes for a nonprofit organization to collect its

Quick Ratio Cash + Securities + Accounts accounts receivable. It provides insight into the

Receivable/Current Liabilities organization's effectiveness in collecting funds

Debt to Asset Total Liabilities / Total Assets owed by donors or other sources.

A lower days receivable ratio is generally

Debt to Total Liabilities / Net Assets

Equity considered more favorable, as it indicates that the

organization collects its receivables more quickly

Asset Total Unrestricted Revenues / Average and efficiently.

Turnover Total Assets

Days Accounts Receivable *365 /

Receivable Unrestricted Revenue

Profit Margin Increase in Unrestricted Net Assets /

Unrestricted Revenue