Page 11 - ANTILL DGB

P. 11

Antilliaans Dagblad Maandag 3 juli 2017 ADVERTENTIE 11

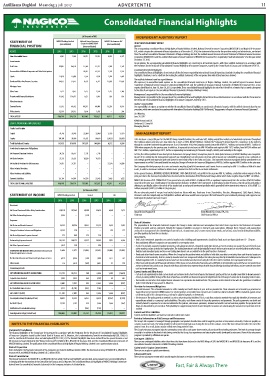

Consolidated Financial Highlights

(In Thousands of NAf)

INDEPENDENT AUDITORS’ REPORT

STATEMENT OF NAGICO Holdings Limited. National General Insurance NAGICO Life Insurance N.V. INDEPENDENT AUDITORS’ REPORT

(Consolidated) Corporation (NAGICO) N.V (Unconsolidated)

FINANCIAL POSITION (Unconsolidated) Opinion

The accompanying consolidated financial highlights of Nagico Holdings Limited, National General Insurance Corporation (NAGICO) N.V. and Nagico Life Insurance

ASSETS 2016 2015 2016 2015 2016 2015 N.V., which comprise the statement of financial position as at December 31, 2016, the statement of income for the year then ended, and related notes, are derived

from the audited consolidated financial statements of Nagico Holdings Limited, the audited General Insurance Annual Statement of National General Insurance

Non-Admissible Assets 6,943 5,308 24,792 19,993 4,819 6,927 Corporation (NAGICO) N.V. and the audited Life Insurance Annual Statement of NAGICO Life Insurance N.V., respectively (“audited statements”), for the year ended

December 31, 2016.

Investments

In our opinion, the accompanying consolidated financial highlights are consistent, in all material respects, with those audited statements, in accordance with

Real Estate 89,887 84,370 27,546 31,211 5,930 2,178 the Provisions for the Disclosure of Consolidated Financial Highlights of Insurance Companies, issued by the Central Bank of Curacao and Sint Maarten (“CBCS”).

Consolidated Financial Highlights

Unconsolidated Affiliated Companies and Other Participations -- -- 70,587 67,273 2,362 1,265

The consolidated financial highlights do not contain all the disclosures required by International Financial Reporting Standards. Reading the consolidated financial

highlights, therefore, is not a substitute for reading the audited statements of the companies from which they have been derived.

Stocks 17,818 25,898 7,554 7,194 1,914 7,481

The audited statements and our report thereon

Bonds and Other Fixed Income Securities 84,953 57,625 8,239 6,371 13,838 11,638 We expressed an unmodified audit opinion on the consolidated financial statements of Nagico Holdings Limited, the audited General Insurance Annual

Statements of National General Insurance Corporation (NAGICO) N.V. and the audited Life Insurance Annual Statements of NAGICO life Insurance N.V., in our

Mortgage Loans -- -- -- -- -- --

reports dated March 4, June 30, June 30, 2017, respectively. These consolidated financial highlights do not reflect the effects of events that occurred subsequent

to the date of our report on the consolidated financial statements of Nagico Holdings Limited.

Other Loans 7,211 7,025 1,775 1,524 1,215 2,146

Management’s responsibility for the consolidated financial highlights

Deposits with Financial Institutions 95,542 116,791 5,725 7,963 626 626 Management is responsible for the preparation of the consolidated financial highlights derived from the audited statements in accordance with the Provisions for

the Disclosure of Consolidated Financial Highlights of Insurance Companies, issued by CBCS.

Other Investments -- -- -- -- -- --

Auditor’s responsibility

Current Assets 75,595 68,762 40,291 40,000 13,207 8,697 Our responsibility is to express an opinion on whether the consolidated financial highlights are consistent, in all material respects, with the audited statements based on our

procedures, which were conducted in accordance with International Standard on Auditing (ISA) 810 (Revised), “Engagements to Report on Summary Financial Statements”.

Other Assets 32,199 28,395 1,474 1,798 -- 366

Sint Maarten,

TOTAL ASSETS 410,148 394,174 187,983 183,327 43,911 41,324 June 30, 2017

KPMG Accountants B.V.

EQUITY, PROVISIONS AND LIABILITIES Lindomar L.P. Scoop RA

Managing Director

Capital and Surplus

Capital 78,345 78,345 22,460 22,460 13,795 13,795 MANAGEMENT REPORT

Surplus 109,188 98,186 85,321 86,076 (7,023) (8,589) 2016 has been a successful year for the NAGICO Group notwithstanding the continued soft, highly competitive markets and weakened economies throughout

the Caribbean where premium rates have fallen by as much as 40%. NAGICO Holdings Limited (the “Company”) demonstrated its competence in the industry

Total Capital and Surplus 187,533 176,531 107,781 108,536 6,772 5,206

through its consistent underwriting performance: as at 31 December 2016, the Company earned a net profit of NAF 11.2 million; an increase of NAF 3.7 million or

49% when compared to the previous year. In addition, it increased its total assets to NAF 410 million and equity to NAF 187.5 million, from NAF 394 million and

Provisions for Insurance Obligations:

NAF 176.5 million, respectively in 2015, further compounding and evidencing its financial strength, stability and leadership in the region.

Net Unearned Premium Provision 36,335 60,777 2,113 7,716 -- -- In 2016, the 50% acquisition transaction by Peak Reinsurance Company Limited, a Hong Kong based A- rated global reinsurer, in NAGICO Holdings was completed.

As part of our enterprise risk management approach we strengthened our reinsurance structure and increased our underwriting capacity as we continued on

Net Claim Provision 21,353 52,652 10,250 14,133 -- --

our strategic growth and expansion path and opened a new branch office in the Turks and Caicos. Our improved reinsurance program directly contributed to an

improvement in our Net Claims and Benefit Incurred plus Change in Provision for Insurance Obligations to NAF 56.6 million against NAF 83 million in the prior year.

Net Technical Provisions for Life Insurances 37,811 37,213 -- -- 33,274 34,286

The Company effectively manages its assets and remains very liquid, with its Investments and Current Assets accounting for NAF 371 million or 90% of its total

Other Technical Provisions -- -- -- -- -- -- assets, in order to ensure we continue to deliver on our promise to be fast and fair in our claim settlements.

Other Provisions and Liabilities -- -- -- -- -- -- In the general business, NATIONAL GENERAL INSURANCE CORP (NAGICO) N.V.’s, net profit for the year was NAF 0.2 million; a reduction when compared to the

prior year due to the increased Corpration Taxes Incurred and the devaluation of the Trinidad and Tobago dollar which had a negative impact of NAF 1.6 million.

Current Liabilities 127,116 67,001 67,839 52,942 3,865 1,832

NAGICO Life Insurance N.V. (“NAGICO Life”) has generated a net profit of NAF 1.6 million in 2016, a significant improvement from the net loss of NAF 0.8 million

TOTAL EQUITY AND LIABILITIES 410,148 394,174 187,983 183,327 43,911 41,324 incurred in the prior year. Contributing to this improved performance is NAGICO Life’s investment in technology to drive efficiency, revised and focused product

offering to specifically address the needs of the market and an enhanced investment portfolio which generated better investment returns in 2016 of NAF 3.5

million compared to NAF 0.3 million in the prior year.

(In Thousands of NAf)

We are extremely proud of our past and excited about our future with you. Thank you to our Shareholders, Directors, Management, Staff, Agents, Brokers,

STATEMENT OF INCOME NAGICO Holdings Limited General Life Reinsurers and most importantly our Policyholders without whom we would have no purpose. We look forward to your continued patronage and support as we

build upon the platform we have created.

2016 2015 2016 2015 2016 2015

Revenues

____________________________________ ____________________________________

Net Earned Premiums & Other Policy Considerations 158,310 187,265 48,388 52,620 6,568 7,473

Imran McSood Amjad ACII Justin Woods H.B. Comm, CPA, CGA

Net Other Underwriting Income 3,404 -- 1,128 -- -- -- Chairman Chief Financial Officer

Expenses

Basis of Estimates

Net Claims and Benefits Incurred 44,345 82,596 18,441 23,132 3,423 3,203 The preparation of the financial statements requires the Group to make estimates and assumptions that affect items reported in the Statement of Financial

Position and profit and loss statement. Notably the insurance liabilities are prone to estimates and assumptions. Although these estimates and assumptions

Change in Provisions for Insurance Obligations 12,242 378 -- -- 159 177 are based on management’s best knowledge of current facts, circumstances and, to some extent, future events and actions, actual results ultimately may differ,

possibly significantly from those estimates.

Net Claim Adjustment Expenses Incurred 273 809 372 736 -- --

Investments

Underwriting Expenses Incurred 101,192 100,373 32,327 30,304 5,071 6,186 • Real Estate: Investment properties are carried at market value. Buildings and improvements classified as fixed assets are depreciated over 10 – 50 years.

• Unconsolidated affiliated companies are accounted for at net equity value.

Net Other Expenses Incurred 1,019 598 -- 590 -- -- • Stocks: This includes unquoted equity investments and trading investments. Unquoted equity investments are investments in companies that are not listed on an

active market, and are carried at net equity value. The trading investments are held principally for resale in the near term and are recorded at their market values.

UNDERWRITING RESULTS (Without Investment Income and 2,643 2,511 (1,624) (2,142) (2,085) (2,093) Realized and unrealized gains and losses on trading investments are accounted for in the profit and loss statement.

Realized Capital Gains or Losses)

• Bonds and other fixed income securities: Where the Group has the positive intent and ability to hold debt securities to maturity, then such financial assets are

Net Investment Income and Earned and Capital Gains or Losses 6,919 4,946 2,700 2,980 3,522 261 classified as held to maturity. Held-to-maturity financial assets are recognized initially at fair value plus any directly attributable transaction costs. Subsequent to

initial recognition, held-to-maturity financial assets are measured at amortized cost using the effective interest method, less any impairment losses.

Other Results 556 3,458 (128) 2,405 81 198 • Other loans and deposits with financial institutions: Other loans are non-derivative financial assets with fixed or determinable payments that are not quoted in an

active market and are carried at cost. Deposits with financial institutions represent deposits with local and foreign banking institutions, and are stated at amortized

Extraordinary Results -- -- -- -- -- -- cost less impairment losses.

Current Assets and Other Assets

NET OPERATIONAL RESULTS BEFORE TAXES 10,118 10,915 948 3,243 1,518 (1,634)

• Cash and cash equivalents include cash on hand and cash invested in short-term financial instruments purchased that are readily convertible to known amounts

of cash, maturing within 90 days of the date of purchase and which are deemed to present insignificant risk of changes in value due to changing interest rates.

Corporate Taxes Incurred 1,849 1,022 463 (419) 48 867

• Receivables are carried at their original invoice amounts less a provision for doubtful debts. The provision is determined in line with the guidelines established

NET OPERATIONAL RESULTS AFTER TAXES 8,269 9,893 485 3,662 1,566 (767) by the Central Bank of Curacao and St. Maarten.

Provision for Insurance Obligations

Net Unrealized Gains or Losses 2,913 (2,392) (253) (116) -- -- • General Insurance: The estimated amounts to settle casualty and health claims at year-end are provided for. These amounts are increased by a provision for

incurred but not yet reported (IBNR) claims. The related portions recoverable from reinsurers are recorded as claims receivable. IBNR is evaluated against actual

NET PROFIT / (LOSS) 11,182 7,501 232 3,546 1,566 (767)

settlements paid in the subsequent year, and may be adjusted upwards or downwards.

Unassigned Earnings (Beginning of Year) 94,883 87,382 76,855 74,228 (8,897) (8,130) • Life Insurance: The policy premium method is used to value the policy liabilities. This is a cash flow valuation method that explicitly identifies all revenues and

expenditures related to a company’s policy liabilities. The policy cash flows consist of the policy premiums and payments. The policy payments are death and

Net Profit / (Loss) 11,182 7,501 232 3,546 1,566 (767) maturity benefits, expenses to service and administer the policies, reinsurance premiums, reinsurance benefits and commissions payable. The projected cash

flows are discounted to present value. Policy liability for supplementary benefits and Group life insurance are valued using the unearned net premium reserve

Distribution of Accumulated Earnings -- -- (954) (919) -- -- method

Current and Other Liabilities

Unassigned Earnings (End of Year) 106,065 94,883 76,133 76,855 (7,331) (8,897)

Current and Other Liabilities are stated at cost unless otherwise stated.

Technical Information on Risk Coverage and Reinsurance

The Group’s risk exposure is managed through geographic and product diversification and through the purchase of reinsurance externally. Claims are payable on

NOTES TO THE FINANCIAL HIGHLIGHTS a claims-occurrence basis. The Group is liable for all insured events that occur during the term of the contract, even if the loss is discovered after the end of the

contract term. As a result, claims may be settled over a long period of time.

Statement of Compliance The Group’s reinsurance program includes catastrophe, excess of loss and quota-share treaties, all purchased from leading reinsurers. The level of coverage bought

The financial highlights of the Group have been prepared in accordance with the Provisions for the Disclosure of Consolidated Financial Highlights annually is in relation to the level of risks being carried by the Group, loss experiences and catastrophe models developed by reinsurers. None of the reinsurance

of Insurance Companies issued by the Central Bank of Curacao and St. Maarten, the Landsverordening Toezicht verzekeringsbedrijf (P.B. 1990,77) program is provided by affiliated companies.

and the Landsbesluit Financiele eisen verzekeringsbedrijf (P.B. 1992,52). The financial highlights have been derived from the general insurance and Contingent Liabilities

life insurance annual statements (the “Annual Statements”) of NAGICO N.V., NAGICO Life Insurance N.V. and the consolidated financial statements of There are no contingent liabilities other than those that have been disclosed in the ARAS filings of 2016 for NAGICO N.V. and NAGICO Life Insurance N.V. and the

NAGICO Holdings Limited. The publication of the consolidated financial highlights of Nagico Holdings Limited is on a purely voluntary basis. consolidated financial statements of NAGICO Holdings Limited.

Basis of Preparation Capital and/or Surplus Commitments

Items included in the financial statements of the companies are stated in Antillean Guilders (NAf). The functional currency of NAGICO N.V., NAGICO Life There are no surplus or capital commitments.

Insurance N.V. and NAGICO Holdings Limited is U.S. dollars (USD). Subsequent Events

Basis of Consolidation There are no subsequent events which would require disclosure or revision to the financial statements.

The Annual Statements for NAGICO N.V. and NAGICO Life from which the financial highlights were derived, were prepared on an unconsolidated basis

in keeping with the instructions of the Central Bank of Curacao and St. Maarten. The consolidated financial highlights of NAGICO Holdings Limited are

derived from the consolidated financial statements for that company, inclusive of all subsidiaries. Fast, Fair & Always There