Page 30 - Virtual Currencies

P. 30

Page 7 of 43

Fileid: … tions/p525/2022/a/xml/cycle08/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Table 1. Cost of $1,000 of 8:29 - 7-Feb-2023

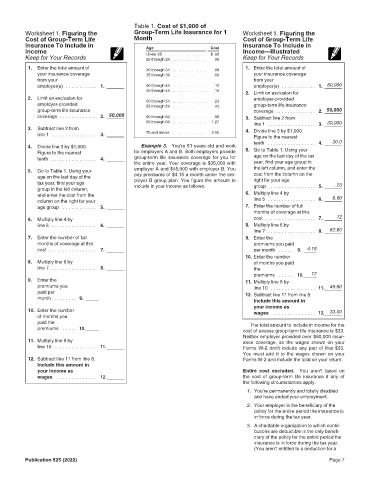

Worksheet 1. Figuring the Group-Term Life Insurance for 1 Worksheet 1. Figuring the

Cost of Group-Term Life Month Cost of Group-Term Life

Insurance To Include in Age Cost Insurance To Include in

Income $ .05 Income—Illustrated

Keep for Your Records Under 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .06 Keep for Your Records

25 through 29 .

1. Enter the total amount of 30 through 34 . . . . . . . . . . . . . . .08 1. Enter the total amount of

your insurance coverage 35 through 39 . . . . . . . . . . . . . . .09 your insurance coverage

from your from your

employer(s) . . . . . . . . . . . 1. 40 through 44 . . . . . . . . . . . . . . .10 employer(s) . . . . . . . . . . . . 1. 80,000

45 through 49 . . . . . . . . . . . . . . .15 2. Limit on exclusion for

2. Limit on exclusion for employer-provided

employer-provided 50 through 54 . . . . . . . . . . . . . . . . . . . . . . . . . . . .23 group-term life insurance

.43

55 through 59 .

group-term life insurance coverage . . . . . . . . . . . . . . 2. 50,000

coverage . . . . . . . . . . . . . 2. 50,000 60 through 64 . . . . . . . . . . . . . . .66 3. Subtract line 2 from

65 through 69 . . . . . . . . . . . . . . 1.27 line 1 . . . . . . . . . . . . . . . . . 3. 30,000

3. Subtract line 2 from 4. Divide line 3 by $1,000.

line 1 . . . . . . . . . . . . . . . . 3. 70 and above . . . . . . . . . . . . . . 2.06 Figure to the nearest

tenth . . . . . . . . . . . . . . . . .

4. Divide line 3 by $1,000. Example 3. You're 51 years old and work 5. Go to Table 1. Using your 4. 30.0

Figure to the nearest for employers A and B. Both employers provide age on the last day of the tax

tenth . . . . . . . . . . . . . . . . 4. group-term life insurance coverage for you for

the entire year. Your coverage is $35,000 with year, find your age group in

5. Go to Table 1. Using your employer A and $45,000 with employer B. You the left column, and enter the

cost from the column on the

age on the last day of the pay premiums of $4.15 a month under the em- right for your age

ployer B group plan. You figure the amount to

tax year, find your age include in your income as follows. group . . . . . . . . . . . . . . . . 5. .23

group in the left column,

and enter the cost from the 6. Multiply line 4 by 6.90

column on the right for your line 5 . . . . . . . . . . . . . . . . . 6.

age group . . . . . . . . . . . . 5. 7. Enter the number of full

months of coverage at this

6. Multiply line 4 by cost . . . . . . . . . . . . . . . . . . 7. 12

line 5 . . . . . . . . . . . . . . . . 6. 8. Multiply line 6 by

line 7 . . . . . . . . . . . . . . . . . 8. 82.80

7. Enter the number of full 9. Enter the

months of coverage at this premiums you paid

cost . . . . . . . . . . . . . . . . . 7. per month . . . . . 9. 4.15

10. Enter the number

8. Multiply line 6 by of months you paid

line 7 . . . . . . . . . . . . . . . . 8. the

premiums . . . . . 10. 12

9. Enter the 11. Multiply line 9 by

premiums you line 10 . . . . . . . . . . . . . . . . 11. 49.80

paid per 12. Subtract line 11 from line 8.

month . . . . . . . . 9. Include this amount in

your income as

10. Enter the number wages . . . . . . . . . . . . . . . 12. 33.00

of months you

paid the The total amount to include in income for the

premiums . . . . . 10. cost of excess group-term life insurance is $33.

Neither employer provided over $50,000 insur-

11. Multiply line 9 by ance coverage, so the wages shown on your

line 10 . . . . . . . . . . . . . . . 11. Forms W-2 don't include any part of that $33.

You must add it to the wages shown on your

12. Subtract line 11 from line 8. Forms W-2 and include the total on your return.

Include this amount in

your income as Entire cost excluded. You aren't taxed on

wages . . . . . . . . . . . . . . 12. the cost of group-term life insurance if any of

the following circumstances apply.

1. You’re permanently and totally disabled

and have ended your employment.

2. Your employer is the beneficiary of the

policy for the entire period the insurance is

in force during the tax year.

3. A charitable organization to which contri-

butions are deductible is the only benefi-

ciary of the policy for the entire period the

insurance is in force during the tax year.

(You aren’t entitled to a deduction for a

Publication 525 (2022) Page 7