Page 101 - Internal Auditing Standards

P. 101

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

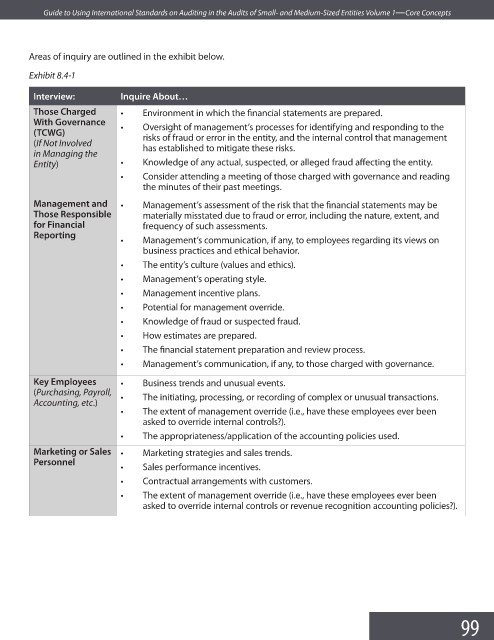

Areas of inquiry are outlined in the exhibit below.

Exhibit 8.4-1

Interview: Inquire About…

Those Charged • Environment in which the financial statements are prepared.

With Governance

(TCWG) • Oversight of management’s processes for identifying and responding to the

(If Not Involved risks of fraud or error in the entity, and the internal control that management

in Managing the has established to mitigate these risks.

Entity) • Knowledge of any actual, suspected, or alleged fraud affecting the entity.

• Consider attending a meeting of those charged with governance and reading

the minutes of their past meetings.

Management and • Management’s assessment of the risk that the financial statements may be

Those Responsible materially misstated due to fraud or error, including the nature, extent, and

for Financial frequency of such assessments.

Reporting

• Management’s communication, if any, to employees regarding its views on

business practices and ethical behavior.

• The entity’s culture (values and ethics).

• Management’s operating style.

• Management incentive plans.

• Potential for management override.

• Knowledge of fraud or suspected fraud.

• How estimates are prepared.

• The financial statement preparation and review process.

• Management’s communication, if any, to those charged with governance.

Key Employees • Business trends and unusual events.

(Purchasing, Payroll, • The initiating, processing, or recording of complex or unusual transactions.

Accounting, etc.)

• The extent of management override (i.e., have these employees ever been

asked to override internal controls?).

• The appropriateness/application of the accounting policies used.

Marketing or Sales • Marketing strategies and sales trends.

Personnel

• Sales performance incentives.

• Contractual arrangements with customers.

• The extent of management override (i.e., have these employees ever been

asked to override internal controls or revenue recognition accounting policies?).

99