Page 100 - Internal Auditing Standards

P. 100

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

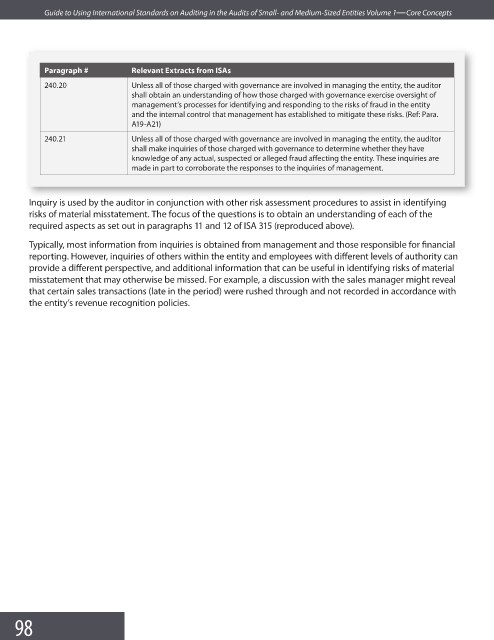

Paragraph # Relevant Extracts from ISAs

240.20 Unless all of those charged with governance are involved in managing the entity, the auditor

shall obtain an understanding of how those charged with governance exercise oversight of

management’s processes for identifying and responding to the risks of fraud in the entity

and the internal control that management has established to mitigate these risks. (Ref: Para.

A19-A21)

240.21 Unless all of those charged with governance are involved in managing the entity, the auditor

shall make inquiries of those charged with governance to determine whether they have

knowledge of any actual, suspected or alleged fraud affecting the entity. These inquiries are

made in part to corroborate the responses to the inquiries of management.

Inquiry is used by the auditor in conjunction with other risk assessment procedures to assist in identifying

risks of material misstatement. The focus of the questions is to obtain an understanding of each of the

required aspects as set out in paragraphs 11 and 12 of ISA 315 (reproduced above).

Typically, most information from inquiries is obtained from management and those responsible for fi nancial

reporting. However, inquiries of others within the entity and employees with different levels of authority can

provide a different perspective, and additional information that can be useful in identifying risks of material

misstatement that may otherwise be missed. For example, a discussion with the sales manager might reveal

that certain sales transactions (late in the period) were rushed through and not recorded in accordance with

the entity’s revenue recognition policies.

98