Page 97 - Internal Auditing Standards

P. 97

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

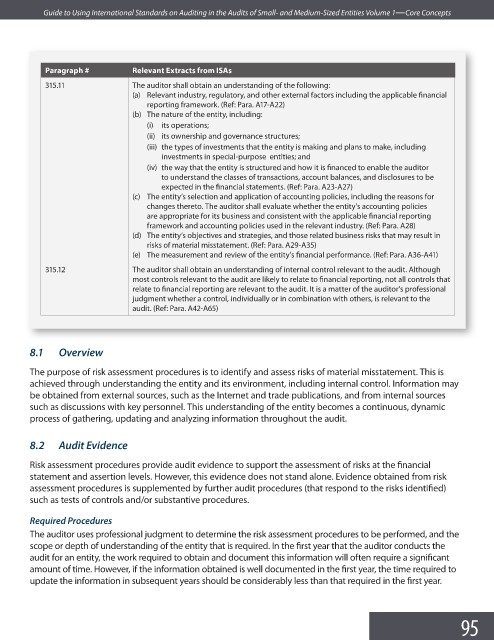

Paragraph # Relevant Extracts from ISAs

315.11 The auditor shall obtain an understanding of the following:

(a) Relevant industry, regulatory, and other external factors including the applicable fi nancial

reporting framework. (Ref: Para. A17-A22)

(b) The nature of the entity, including:

(i) its operations;

(ii) its ownership and governance structures;

(iii) the types of investments that the entity is making and plans to make, including

investments in special-purpose entities; and

(iv) the way that the entity is structured and how it is financed to enable the auditor

to understand the classes of transactions, account balances, and disclosures to be

expected in the financial statements. (Ref: Para. A23-A27)

(c) The entity’s selection and application of accounting policies, including the reasons for

changes thereto. The auditor shall evaluate whether the entity’s accounting policies

are appropriate for its business and consistent with the applicable fi nancial reporting

framework and accounting policies used in the relevant industry. (Ref: Para. A28)

(d) The entity’s objectives and strategies, and those related business risks that may result in

risks of material misstatement. (Ref: Para. A29-A35)

(e) The measurement and review of the entity’s financial performance. (Ref: Para. A36-A41)

315.12 The auditor shall obtain an understanding of internal control relevant to the audit. Although

most controls relevant to the audit are likely to relate to financial reporting, not all controls that

relate to financial reporting are relevant to the audit. It is a matter of the auditor’s professional

judgment whether a control, individually or in combination with others, is relevant to the

audit. (Ref: Para. A42-A65)

8.1 Overview

The purpose of risk assessment procedures is to identify and assess risks of material misstatement. This is

achieved through understanding the entity and its environment, including internal control. Information may

be obtained from external sources, such as the Internet and trade publications, and from internal sources

such as discussions with key personnel. This understanding of the entity becomes a continuous, dynamic

process of gathering, updating and analyzing information throughout the audit.

8.2 Audit Evidence

Risk assessment procedures provide audit evidence to support the assessment of risks at the fi nancial

statement and assertion levels. However, this evidence does not stand alone. Evidence obtained from risk

assessment procedures is supplemented by further audit procedures (that respond to the risks identifi ed)

such as tests of controls and/or substantive procedures.

Required Procedures

The auditor uses professional judgment to determine the risk assessment procedures to be performed, and the

scope or depth of understanding of the entity that is required. In the first year that the auditor conducts the

audit for an entity, the work required to obtain and document this information will often require a signifi cant

amount of time. However, if the information obtained is well documented in the first year, the time required to

update the information in subsequent years should be considerably less than that required in the fi rst year.

95