Page 94 - Internal Auditing Standards

P. 94

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

The determination of performance materiality involves the exercise of professional judgment based on factors

that address audit risk, such as the following:

• Understanding of the entity and the results of performing risk assessment procedures;

• Nature and extent of misstatements identified in previous audits; and,

• Expectations of possible misstatements in the current period.

Performance materiality as a whole or for individual balances, transactions, and disclosures may have to be

changed at any time during the audit (without impacting overall materiality) to reflect revised risk assessments,

audit findings, and new information obtained. At the conclusion of the audit, the overall materiality would be

used for evaluating the effect of identified misstatements on the financial statements and determining the

opinion to be expressed in the auditor’s report. (See Volume 2, Chapter 21 for further guidance.)

CONSIDER POINT

When a possible misstatement is identified, address the circumstances of occurrence and the impact on

risk assessments/audit plans before reconsidering performance materiality.

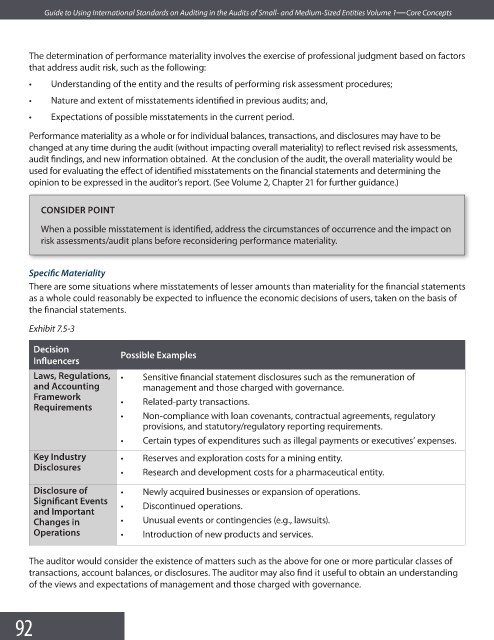

Specifi c Materiality

There are some situations where misstatements of lesser amounts than materiality for the fi nancial statements

as a whole could reasonably be expected to influence the economic decisions of users, taken on the basis of

the fi nancial statements.

Exhibit 7.5-3

Decision

Possible Examples

Infl uencers

Laws, Regulations, • Sensitive financial statement disclosures such as the remuneration of

and Accounting management and those charged with governance.

Framework • Related-party transactions.

Requirements

• Non-compliance with loan covenants, contractual agreements, regulatory

provisions, and statutory/regulatory reporting requirements.

• Certain types of expenditures such as illegal payments or executives’ expenses.

Key Industry • Reserves and exploration costs for a mining entity.

Disclosures

• Research and development costs for a pharmaceutical entity.

Disclosure of • Newly acquired businesses or expansion of operations.

Signifi cant Events • Discontinued operations.

and Important

Changes in • Unusual events or contingencies (e.g., lawsuits).

Operations • Introduction of new products and services.

The auditor would consider the existence of matters such as the above for one or more particular classes of

transactions, account balances, or disclosures. The auditor may also find it useful to obtain an understanding

of the views and expectations of management and those charged with governance.

92