Page 92 - Internal Auditing Standards

P. 92

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

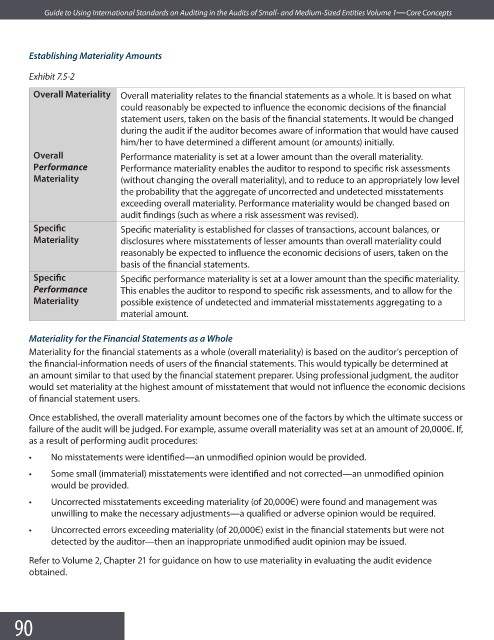

Establishing Materiality Amounts

Exhibit 7.5-2

Overall Materiality Overall materiality relates to the financial statements as a whole. It is based on what

could reasonably be expected to influence the economic decisions of the fi nancial

statement users, taken on the basis of the financial statements. It would be changed

during the audit if the auditor becomes aware of information that would have caused

him/her to have determined a different amount (or amounts) initially.

Overall Performance materiality is set at a lower amount than the overall materiality.

Performance Performance materiality enables the auditor to respond to specific risk assessments

Materiality (without changing the overall materiality), and to reduce to an appropriately low level

the probability that the aggregate of uncorrected and undetected misstatements

exceeding overall materiality. Performance materiality would be changed based on

audit findings (such as where a risk assessment was revised).

Specifi c Specific materiality is established for classes of transactions, account balances, or

Materiality disclosures where misstatements of lesser amounts than overall materiality could

reasonably be expected to influence the economic decisions of users, taken on the

basis of the fi nancial statements.

Specifi c Specific performance materiality is set at a lower amount than the specifi c materiality.

Performance This enables the auditor to respond to specific risk assessments, and to allow for the

Materiality possible existence of undetected and immaterial misstatements aggregating to a

material amount.

Materiality for the Financial Statements as a Whole

Materiality for the financial statements as a whole (overall materiality) is based on the auditor’s perception of

the financial-information needs of users of the financial statements. This would typically be determined at

an amount similar to that used by the financial statement preparer. Using professional judgment, the auditor

would set materiality at the highest amount of misstatement that would not influence the economic decisions

of financial statement users.

Once established, the overall materiality amount becomes one of the factors by which the ultimate success or

failure of the audit will be judged. For example, assume overall materiality was set at an amount of 20,000Є. If,

as a result of performing audit procedures:

• No misstatements were identifi ed—an unmodified opinion would be provided.

• Some small (immaterial) misstatements were identified and not corrected—an unmodifi ed opinion

would be provided.

• Uncorrected misstatements exceeding materiality (of 20,000Є) were found and management was

unwilling to make the necessary adjustments—a qualified or adverse opinion would be required.

• Uncorrected errors exceeding materiality (of 20,000Є) exist in the financial statements but were not

detected by the auditor—then an inappropriate unmodified audit opinion may be issued.

Refer to Volume 2, Chapter 21 for guidance on how to use materiality in evaluating the audit evidence

obtained.

90