Page 88 - Internal Auditing Standards

P. 88

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

The responsibility of the auditor is to reduce to an appropriately low level the probability that the aggregate of

uncorrected and undetected misstatements in the financial statements exceeds the materiality for the fi nancial

statements as a whole. If the auditor simply planned to perform audit procedures that would identify individual

misstatements exceeding 10,000Є, there is a risk that the aggregate of individually immaterial misstatements

not identified during the audit would result in the 10,000Є materiality threshold being exceeded. So the auditor

needs to perform some additional work that is sufficient to allow for a margin or buffer for possible undetected

misstatements. The purpose of performance materiality is to provide such a buff er.

Performance materiality enables the auditor to establish materiality amounts (based upon, but lower than,

overall materiality) that reflect the risk assessments for the various financial statement areas. These lower

amounts provide a safety buffer between the materiality (performance materiality) used for determining the

nature and extent of audit procedures to be performed and the overall materiality.

In the example above, the auditor using professional judgment may decide that a performance materiality of

6,000Є would be used in designing the extent of the audit procedures to be performed. The buffer of 4,000Є

(10,000Є - 6,000Є) between performance materiality and overall materiality provides a safety margin for any

undetected misstatements that may exist.

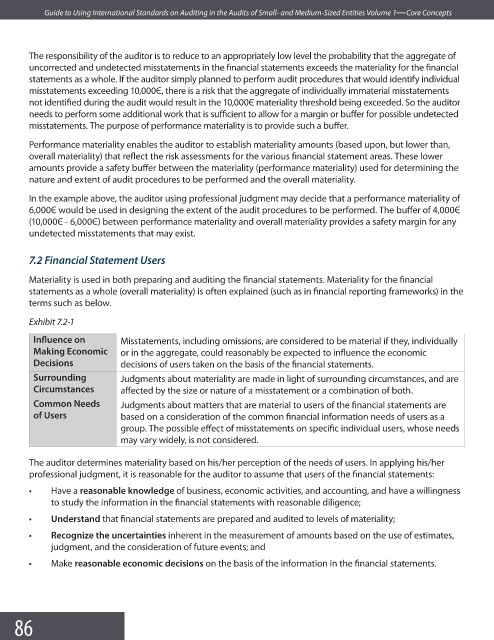

7.2 Financial Statement Users

Materiality is used in both preparing and auditing the financial statements. Materiality for the fi nancial

statements as a whole (overall materiality) is often explained (such as in financial reporting frameworks) in the

terms such as below.

Exhibit 7.2-1

Infl uence on Misstatements, including omissions, are considered to be material if they, individually

Making Economic or in the aggregate, could reasonably be expected to influence the economic

Decisions decisions of users taken on the basis of the fi nancial statements.

Surrounding Judgments about materiality are made in light of surrounding circumstances, and are

Circumstances affected by the size or nature of a misstatement or a combination of both.

Common Needs Judgments about matters that are material to users of the financial statements are

of Users based on a consideration of the common financial information needs of users as a

group. The possible effect of misstatements on specific individual users, whose needs

may vary widely, is not considered.

The auditor determines materiality based on his/her perception of the needs of users. In applying his/her

professional judgment, it is reasonable for the auditor to assume that users of the fi nancial statements:

a

• Have reasonable knowledge of business, economic activities, and accounting, and have a willingness

to study the information in the financial statements with reasonable diligence;

• Understand that financial statements are prepared and audited to levels of materiality;

• Recognize the uncertainties inherent in the measurement of amounts based on the use of estimates,

judgment, and the consideration of future events; and

• Make reasonable economic decisions on the basis of the information in the fi nancial statements.

86