Page 83 - Internal Auditing Standards

P. 83

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

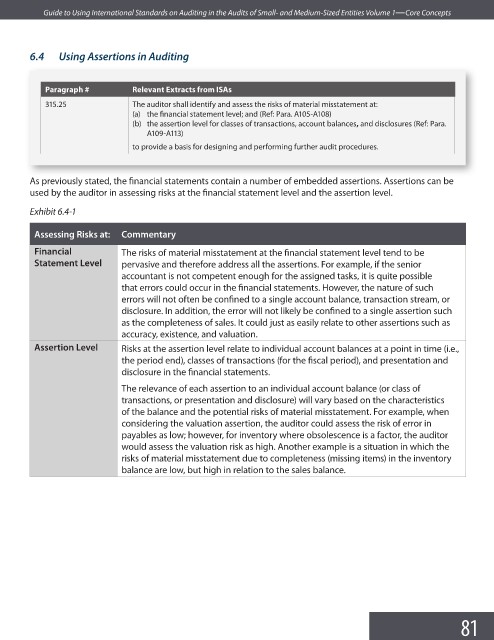

6.4 Using Assertions in Auditing

Paragraph # Relevant Extracts from ISAs

315.25 The auditor shall identify and assess the risks of material misstatement at:

(a) the financial statement level; and (Ref: Para. A105-A108)

(b) the assertion level for classes of transactions, account balances, and disclosures (Ref: Para.

A109-A113)

to provide a basis for designing and performing further audit procedures.

As previously stated, the financial statements contain a number of embedded assertions. Assertions can be

used by the auditor in assessing risks at the financial statement level and the assertion level.

Exhibit 6.4-1

Assessing Risks at: Commentary

Financial The risks of material misstatement at the financial statement level tend to be

Statement Level pervasive and therefore address all the assertions. For example, if the senior

accountant is not competent enough for the assigned tasks, it is quite possible

that errors could occur in the financial statements. However, the nature of such

errors will not often be confined to a single account balance, transaction stream, or

disclosure. In addition, the error will not likely be confined to a single assertion such

as the completeness of sales. It could just as easily relate to other assertions such as

accuracy, existence, and valuation.

Assertion Level Risks at the assertion level relate to individual account balances at a point in time (i.e.,

the period end), classes of transactions (for the fiscal period), and presentation and

disclosure in the fi nancial statements.

The relevance of each assertion to an individual account balance (or class of

transactions, or presentation and disclosure) will vary based on the characteristics

of the balance and the potential risks of material misstatement. For example, when

considering the valuation assertion, the auditor could assess the risk of error in

payables as low; however, for inventory where obsolescence is a factor, the auditor

would assess the valuation risk as high. Another example is a situation in which the

risks of material misstatement due to completeness (missing items) in the inventory

balance are low, but high in relation to the sales balance.

81