Page 87 - Internal Auditing Standards

P. 87

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

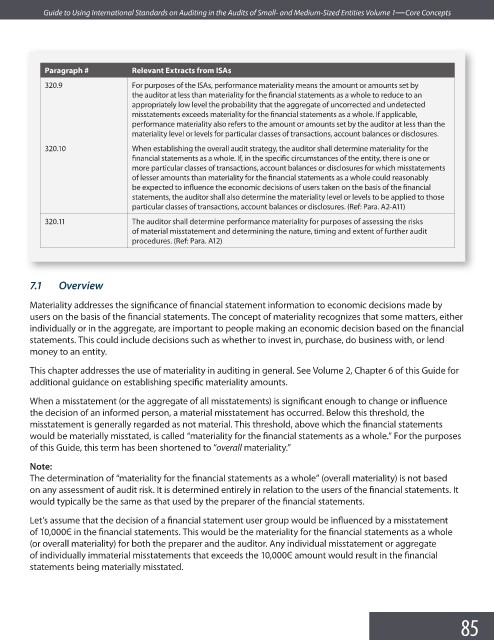

Paragraph # Relevant Extracts from ISAs

320.9 For purposes of the ISAs, performance materiality means the amount or amounts set by

the auditor at less than materiality for the financial statements as a whole to reduce to an

appropriately low level the probability that the aggregate of uncorrected and undetected

misstatements exceeds materiality for the financial statements as a whole. If applicable,

performance materiality also refers to the amount or amounts set by the auditor at less than the

materiality level or levels for particular classes of transactions, account balances or disclosures.

320.10 When establishing the overall audit strategy, the auditor shall determine materiality for the

financial statements as a whole. If, in the specific circumstances of the entity, there is one or

more particular classes of transactions, account balances or disclosures for which misstatements

of lesser amounts than materiality for the financial statements as a whole could reasonably

be expected to influence the economic decisions of users taken on the basis of the fi nancial

statements, the auditor shall also determine the materiality level or levels to be applied to those

particular classes of transactions, account balances or disclosures. (Ref: Para. A2-A11)

320.11 The auditor shall determine performance materiality for purposes of assessing the risks

of material misstatement and determining the nature, timing and extent of further audit

procedures. (Ref: Para. A12)

7.1 Overview

Materiality addresses the significance of financial statement information to economic decisions made by

users on the basis of the financial statements. The concept of materiality recognizes that some matters, either

individually or in the aggregate, are important to people making an economic decision based on the fi nancial

statements. This could include decisions such as whether to invest in, purchase, do business with, or lend

money to an entity.

This chapter addresses the use of materiality in auditing in general. See Volume 2, Chapter 6 of this Guide for

additional guidance on establishing specific materiality amounts.

When a misstatement (or the aggregate of all misstatements) is significant enough to change or infl uence

the decision of an informed person, a material misstatement has occurred. Below this threshold, the

misstatement is generally regarded as not material. This threshold, above which the fi nancial statements

would be materially misstated, is called “materiality for the financial statements as a whole.” For the purposes

of this Guide, this term has been shortened to “overall materiality.”

Note:

The determination of “materiality for the financial statements as a whole” (overall materiality) is not based

on any assessment of audit risk. It is determined entirely in relation to the users of the financial statements. It

would typically be the same as that used by the preparer of the fi nancial statements.

Let’s assume that the decision of a financial statement user group would be influenced by a misstatement

of 10,000Є in the financial statements. This would be the materiality for the financial statements as a whole

(or overall materiality) for both the preparer and the auditor. Any individual misstatement or aggregate

of individually immaterial misstatements that exceeds the 10,000Є amount would result in the fi nancial

statements being materially misstated.

85