Page 89 - Internal Auditing Standards

P. 89

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

7.3 Nature of Misstatements

Misstatements may arise from a number of causes and can be based on the following:

• Size—the monetary amount involved (quantitative);

• Nature of the item (qualitative); and

• Circumstances surrounding the occurrence.

Exhibit 7.3-1

Typical • Errors and fraud identified in the preparation of the fi nancial statements;

Misstatements • Departures from the applicable financial reporting framework;

• Fraud perpetrated by employees or management;

• Management error;

• Preparation of inaccurate or inappropriate estimates; or

• Inappropriate or incomplete descriptions of accounting policies or note

disclosures.

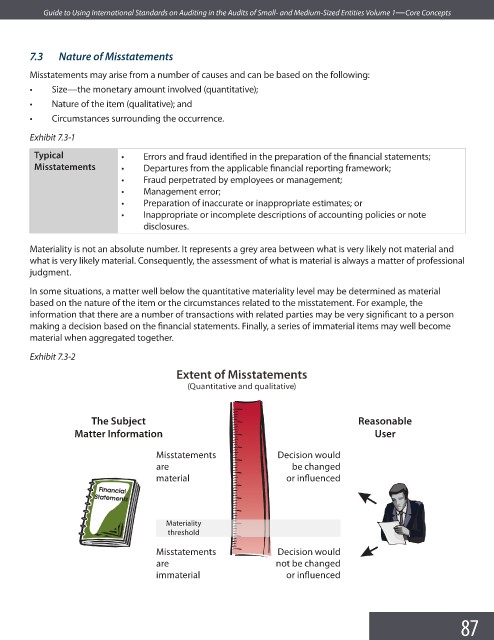

Materiality is not an absolute number. It represents a grey area between what is very likely not material and

what is very likely material. Consequently, the assessment of what is material is always a matter of professional

judgment.

In some situations, a matter well below the quantitative materiality level may be determined as material

based on the nature of the item or the circumstances related to the misstatement. For example, the

information that there are a number of transactions with related parties may be very significant to a person

making a decision based on the financial statements. Finally, a series of immaterial items may well become

material when aggregated together.

Exhibit 7.3-2

Extent of Misstatements

(Quantitative and qualitative)

The Subject Reasonable

Matter Information User

Misstatements Decision would

are be changed

material or influenced

Materiality

threshold

Misstatements Decision would

are not be changed

immaterial or influenced

87