Page 84 - Internal Auditing Standards

P. 84

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

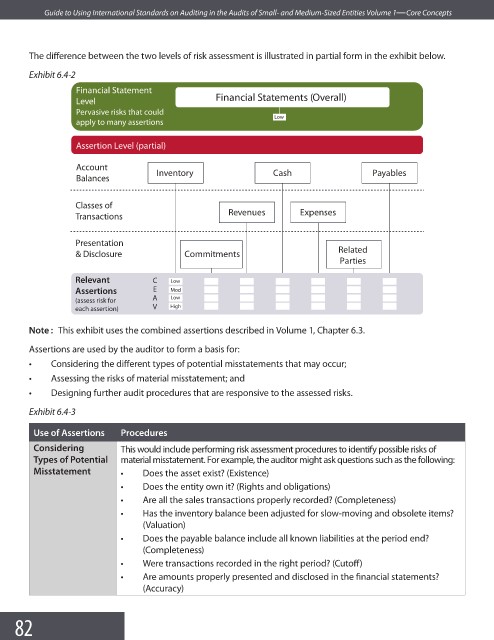

The difference between the two levels of risk assessment is illustrated in partial form in the exhibit below.

Exhibit 6.4-2

Financial Statement

Level Financial Statements (Overall)

Pervasive risks that could

Low

apply to many assertions

Assertion Level (partial)

Account

Balances Inventory Cash Payables

Classes of

Transactions Revenues Expenses

Presentation

Related

& Disclosure Commitments

Parties

Relevant C Low

Assertions E Mod

(assess risk for A Low

each assertion) V High

Note : This exhibit uses the combined assertions described in Volume 1, Chapter 6.3.

Assertions are used by the auditor to form a basis for:

• Considering the different types of potential misstatements that may occur;

• Assessing the risks of material misstatement; and

• Designing further audit procedures that are responsive to the assessed risks.

Exhibit 6.4-3

Use of Assertions Procedures

Considering This would include performing risk assessment procedures to identify possible risks of

Types of Potential material misstatement. For example, the auditor might ask questions such as the following:

Misstatement • Does the asset exist? (Existence)

• Does the entity own it? (Rights and obligations)

• Are all the sales transactions properly recorded? (Completeness)

• Has the inventory balance been adjusted for slow-moving and obsolete items?

(Valuation)

• Does the payable balance include all known liabilities at the period end?

(Completeness)

• Were transactions recorded in the right period? (Cutoff )

• Are amounts properly presented and disclosed in the fi nancial statements?

(Accuracy)

82