Page 90 - Internal Auditing Standards

P. 90

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

7.4 Materiality and Audit Risk

Materiality (as discussed above) and audit risk are related, and are considered together throughout the audit

process.

Audit risk is the possibility that an auditor expresses an inappropriate audit opinion on fi nancial statements

that are materially misstated.

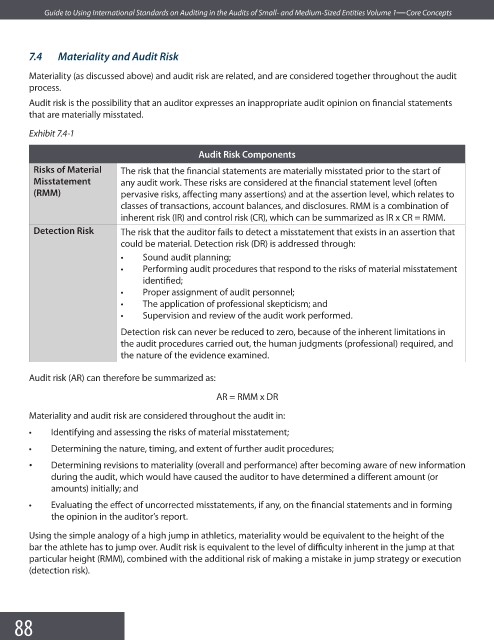

Exhibit 7.4-1

Audit Risk Components

Risks of Material The risk that the financial statements are materially misstated prior to the start of

Misstatement any audit work. These risks are considered at the financial statement level (often

(RMM) pervasive risks, affecting many assertions) and at the assertion level, which relates to

classes of transactions, account balances, and disclosures. RMM is a combination of

inherent risk (IR) and control risk (CR), which can be summarized as IR x CR = RMM.

Detection Risk The risk that the auditor fails to detect a misstatement that exists in an assertion that

could be material. Detection risk (DR) is addressed through:

• Sound audit planning;

• Performing audit procedures that respond to the risks of material misstatement

identifi ed;

• Proper assignment of audit personnel;

• The application of professional skepticism; and

• Supervision and review of the audit work performed.

Detection risk can never be reduced to zero, because of the inherent limitations in

the audit procedures carried out, the human judgments (professional) required, and

the nature of the evidence examined.

Audit risk (AR) can therefore be summarized as:

AR = RMM x DR

Materiality and audit risk are considered throughout the audit in:

• Identifying and assessing the risks of material misstatement;

• Determining the nature, timing, and extent of further audit procedures;

• Determining revisions to materiality (overall and performance) after becoming aware of new information

during the audit, which would have caused the auditor to have determined a different amount (or

amounts) initially; and

• Evaluating the effect of uncorrected misstatements, if any, on the financial statements and in forming

the opinion in the auditor’s report.

Using the simple analogy of a high jump in athletics, materiality would be equivalent to the height of the

bar the athlete has to jump over. Audit risk is equivalent to the level of difficulty inherent in the jump at that

particular height (RMM), combined with the additional risk of making a mistake in jump strategy or execution

(detection risk).

88