Page 95 - Internal Auditing Standards

P. 95

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

Specific Performance Materiality

This is the same as the performance materiality discussed above, except that it relates to the amounts set

for specific materiality. Specific performance materiality would be set at a smaller amount than specifi c

materiality, to ensure sufficient audit work is performed to reduce to an appropriately low level the

probability that the aggregate of uncorrected and undetected misstatements exceeds the specifi c materiality.

7.6 Documentation of Materiality

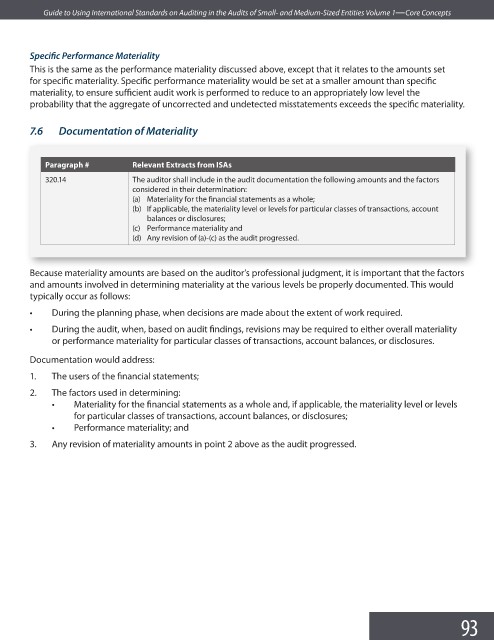

Paragraph # Relevant Extracts from ISAs

320.14 The auditor shall include in the audit documentation the following amounts and the factors

considered in their determination:

(a) Materiality for the financial statements as a whole;

(b) If applicable, the materiality level or levels for particular classes of transactions, account

balances or disclosures;

(c) Performance materiality and

(d) Any revision of (a)-(c) as the audit progressed.

Because materiality amounts are based on the auditor’s professional judgment, it is important that the factors

and amounts involved in determining materiality at the various levels be properly documented. This would

typically occur as follows:

• During the planning phase, when decisions are made about the extent of work required.

• During the audit, when, based on audit findings, revisions may be required to either overall materiality

or performance materiality for particular classes of transactions, account balances, or disclosures.

Documentation would address:

1. The users of the fi nancial statements;

2. The factors used in determining:

• Materiality for the financial statements as a whole and, if applicable, the materiality level or levels

for particular classes of transactions, account balances, or disclosures;

• Performance materiality; and

3. Any revision of materiality amounts in point 2 above as the audit progressed.

93