Page 134 - Internal Auditing Standards

P. 134

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

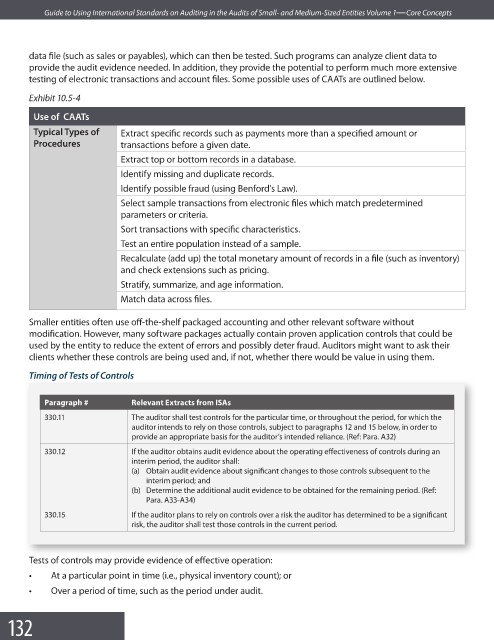

data file (such as sales or payables), which can then be tested. Such programs can analyze client data to

provide the audit evidence needed. In addition, they provide the potential to perform much more extensive

testing of electronic transactions and account files. Some possible uses of CAATs are outlined below.

Exhibit 10.5-4

Use of CAATs

Typical Types of Extract specific records such as payments more than a specified amount or

Procedures transactions before a given date.

Extract top or bottom records in a database.

Identify missing and duplicate records.

Identify possible fraud (using Benford's Law).

Select sample transactions from electronic files which match predetermined

parameters or criteria.

Sort transactions with specifi c characteristics.

Test an entire population instead of a sample.

Recalculate (add up) the total monetary amount of records in a file (such as inventory)

and check extensions such as pricing.

Stratify, summarize, and age information.

Match data across fi les.

Smaller entities often use off-the-shelf packaged accounting and other relevant software without

modification. However, many software packages actually contain proven application controls that could be

used by the entity to reduce the extent of errors and possibly deter fraud. Auditors might want to ask their

clients whether these controls are being used and, if not, whether there would be value in using them.

g

Timing of Tests of Controls

Paragraph # Relevant Extracts from ISAs

330.11 The auditor shall test controls for the particular time, or throughout the period, for which the

auditor intends to rely on those controls, subject to paragraphs 12 and 15 below, in order to

provide an appropriate basis for the auditor’s intended reliance. (Ref: Para. A32)

330.12 If the auditor obtains audit evidence about the operating effectiveness of controls during an

interim period, the auditor shall:

(a) Obtain audit evidence about significant changes to those controls subsequent to the

interim period; and

(b) Determine the additional audit evidence to be obtained for the remaining period. (Ref:

Para. A33-A34)

330.15 If the auditor plans to rely on controls over a risk the auditor has determined to be a signifi cant

risk, the auditor shall test those controls in the current period.

Tests of controls may provide evidence of eff ective operation:

• At a particular point in time (i.e., physical inventory count); or

• Over a period of time, such as the period under audit.

132