Page 200 - Internal Auditing Standards

P. 200

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

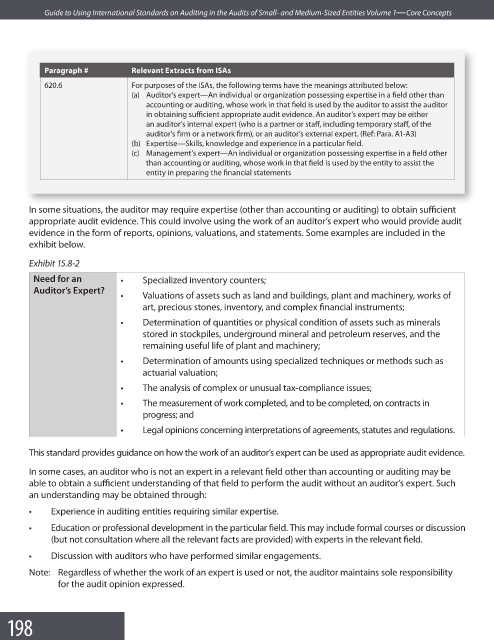

Paragraph # Relevant Extracts from ISAs

620.6 For purposes of the ISAs, the following terms have the meanings attributed below:

(a) Auditor’s expert—An individual or organization possessing expertise in a field other than

accounting or auditing, whose work in that field is used by the auditor to assist the auditor

in obtaining sufficient appropriate audit evidence. An auditor’s expert may be either

an auditor’s internal expert (who is a partner or staff, including temporary staff, of the

auditor’s firm or a network firm), or an auditor’s external expert. (Ref: Para. A1-A3)

(b) Expertise—Skills, knowledge and experience in a particular fi eld.

(c) Management’s expert—An individual or organization possessing expertise in a fi eld other

than accounting or auditing, whose work in that field is used by the entity to assist the

entity in preparing the fi nancial statements

In some situations, the auditor may require expertise (other than accounting or auditing) to obtain suffi cient

appropriate audit evidence. This could involve using the work of an auditor’s expert who would provide audit

evidence in the form of reports, opinions, valuations, and statements. Some examples are included in the

exhibit below.

Exhibit 15.8-2

Need for an • Specialized inventory counters;

Auditor’s Expert?

• Valuations of assets such as land and buildings, plant and machinery, works of

art, precious stones, inventory, and complex fi nancial instruments;

• Determination of quantities or physical condition of assets such as minerals

stored in stockpiles, underground mineral and petroleum reserves, and the

remaining useful life of plant and machinery;

• Determination of amounts using specialized techniques or methods such as

actuarial valuation;

• The analysis of complex or unusual tax-compliance issues;

• The measurement of work completed, and to be completed, on contracts in

progress; and

• Legal opinions concerning interpretations of agreements, statutes and regulations.

This standard provides guidance on how the work of an auditor’s expert can be used as appropriate audit evidence.

In some cases, an auditor who is not an expert in a relevant field other than accounting or auditing may be

able to obtain a sufficient understanding of that field to perform the audit without an auditor’s expert. Such

an understanding may be obtained through:

• Experience in auditing entities requiring similar expertise.

• Education or professional development in the particular field. This may include formal courses or discussion

(but not consultation where all the relevant facts are provided) with experts in the relevant fi eld.

• Discussion with auditors who have performed similar engagements.

Note: Regardless of whether the work of an expert is used or not, the auditor maintains sole responsibility

for the audit opinion expressed.

198