Page 226 - Internal Auditing Standards

P. 226

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

Paragraph # Relevant Extracts from ISAs

700.18 If financial statements prepared in accordance with the requirements of a fair presentation

framework do not achieve fair presentation, the auditor shall discuss the matter with

management and, depending on the requirements of the applicable fi nancial reporting

framework and how the matter is resolved, shall determine whether it is necessary to modify

the opinion in the auditor’s report in accordance with ISA 705. (Ref: Para. A11)

700.19 When the financial statements are prepared in accordance with a compliance framework, the

auditor is not required to evaluate whether the financial statements achieve fair presentation.

However, if in extremely rare circumstances the auditor concludes that such fi nancial

statements are misleading, the auditor shall discuss the matter with management and,

depending on how it is resolved, shall determine whether, and how, to communicate it in the

auditor’s report. (Ref: Para. A12)

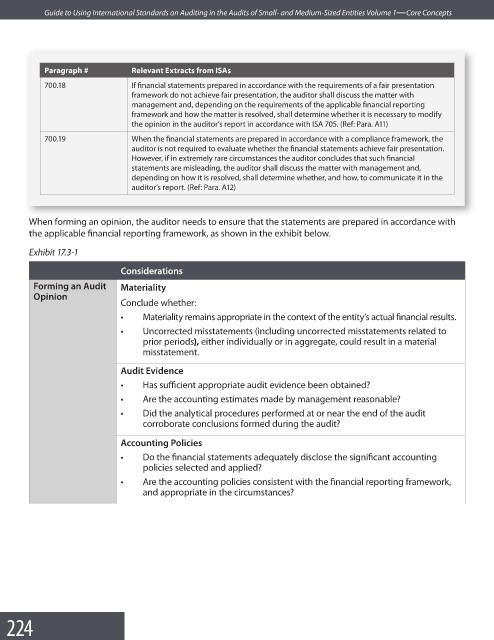

When forming an opinion, the auditor needs to ensure that the statements are prepared in accordance with

the applicable financial reporting framework, as shown in the exhibit below.

Exhibit 17.3-1

Considerations

Forming an Audit Materiality

Opinion

Conclude whether:

• Materiality remains appropriate in the context of the entity’s actual fi nancial results.

• Uncorrected misstatements (including uncorrected misstatements related to

prior periods), either individually or in aggregate, could result in a material

misstatement.

Audit Evidence

• Has sufficient appropriate audit evidence been obtained?

• Are the accounting estimates made by management reasonable?

• Did the analytical procedures performed at or near the end of the audit

corroborate conclusions formed during the audit?

Accounting Policies

• Do the financial statements adequately disclose the signifi cant accounting

policies selected and applied?

• Are the accounting policies consistent with the financial reporting framework,

and appropriate in the circumstances?

224