Page 43 - Internal Auditing Standards

P. 43

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

The IFAC Guide to Quality Control for Small- and Medium-Sized Practices provides a detailed description of

the quality control standards and guidance on how to implement a system of quality control for small- and

medium-sized practices (SMPs). 2

The Code of Ethics for Professional Accountants, issued by the IESBA, can be downloaded from the IFAC web

site. In 2009, a revised Code of Ethics for Professional Accountants was issued that clarifies some requirements,

and significantly strengthens the independence requirements of auditors, such as those outlined below:

• Extending the independence requirements for audits of listed entities to all public-interest entities;

• Requiring a cooling-off period before certain members of the firm can join public-interest audit clients

in certain specifi ed positions;

• Extending partner-rotation requirements to all key audit partners;

• Strengthening some of the provisions related to the provision of non-assurance services to audit clients,

such as tax planning and other advisory services. Some prohibitions may apply in cases of non-public-

interest entities audits with regard to tax planning and other advisory services, as well as to assistance in

resolution of tax services;

• Requiring a pre- or post-issuance review if total fees from a public-interest audit client exceed 15% of the

total fees of the firm for two consecutive years; and

• Prohibiting key audit partners from being evaluated on, or compensated for, selling non-assurance

services to their audit clients.

The revised Code will be effective from January 1, 2011.

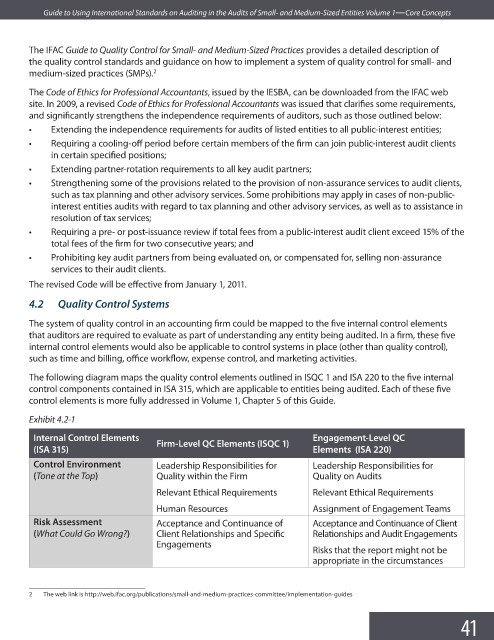

4.2 Quality Control Systems

The system of quality control in an accounting firm could be mapped to the five internal control elements

that auditors are required to evaluate as part of understanding any entity being audited. In a firm, these fi ve

internal control elements would also be applicable to control systems in place (other than quality control),

such as time and billing, offi ce workflow, expense control, and marketing activities.

The following diagram maps the quality control elements outlined in ISQC 1 and ISA 220 to the fi ve internal

control components contained in ISA 315, which are applicable to entities being audited. Each of these fi ve

control elements is more fully addressed in Volume 1, Chapter 5 of this Guide.

Exhibit 4.2-1

Internal Control Elements Engagement-Level QC

Firm-Level QC Elements (ISQC 1)

(ISA 315) Elements (ISA 220)

Control Environment Leadership Responsibilities for Leadership Responsibilities for

(Tone at the Top) Quality within the Firm Quality on Audits

Relevant Ethical Requirements Relevant Ethical Requirements

Human Resources Assignment of Engagement Teams

Risk Assessment Acceptance and Continuance of Acceptance and Continuance of Client

(What Could Go Wrong?) Client Relationships and Specifi c Relationships and Audit Engagements

Engagements

Risks that the report might not be

appropriate in the circumstances

2 The web link is http://web.ifac.org/publications/small-and-medium-practices-committee/implementation-guides

41