Page 46 - Internal Auditing Standards

P. 46

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

4.4 Firm Risk Assessment

Risk management is an ongoing process that helps a firm to anticipate negative events, develop a framework

for effective decision-making, and profitably deploy the fi rm’s resources.

Some form of risk management occurs in most firms, and it is often informal and undocumented. Individual

partners typically identify risks and respond to them based on their direct involvement with the fi rm and

with their clients. Formalizing and documenting the process for the firm as a whole is a proactive and

more effective approach to risk assessment. This does not have to be time-consuming or cumbersome to

implement. Notably, effectively managing the firm’s risk assessment can result in less stress for partners and

staff, savings in time and costs, and improved chances of achieving the fi rm’s goals.

A simple risk assessment process can be used in any size of firm, even a sole proprietorship. It consists of the

activities set out below.

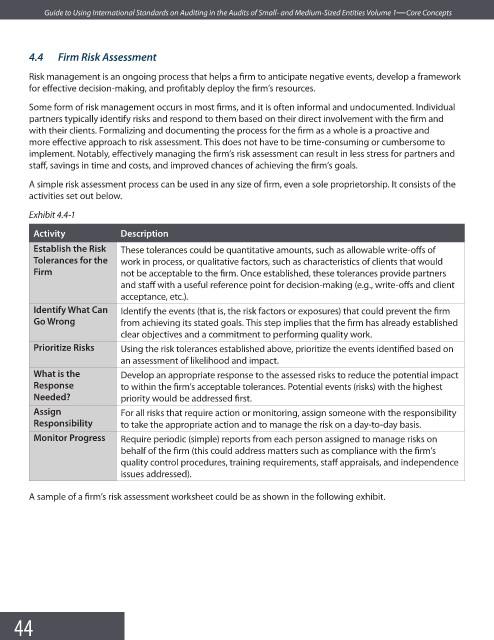

Exhibit 4.4-1

Activity Description

Establish the Risk These tolerances could be quantitative amounts, such as allowable write-off s of

Tolerances for the work in process, or qualitative factors, such as characteristics of clients that would

Firm not be acceptable to the firm. Once established, these tolerances provide partners

and staff with a useful reference point for decision-making (e.g., write-offs and client

acceptance, etc.).

Identify What Can Identify the events (that is, the risk factors or exposures) that could prevent the fi rm

Go Wrong from achieving its stated goals. This step implies that the firm has already established

clear objectives and a commitment to performing quality work.

Prioritize Risks Using the risk tolerances established above, prioritize the events identified based on

an assessment of likelihood and impact.

What is the Develop an appropriate response to the assessed risks to reduce the potential impact

Response to within the firm’s acceptable tolerances. Potential events (risks) with the highest

Needed? priority would be addressed fi rst.

Assign For all risks that require action or monitoring, assign someone with the responsibility

Responsibility to take the appropriate action and to manage the risk on a day-to-day basis.

Monitor Progress Require periodic (simple) reports from each person assigned to manage risks on

behalf of the firm (this could address matters such as compliance with the fi rm’s

quality control procedures, training requirements, staff appraisals, and independence

issues addressed).

A sample of a firm’s risk assessment worksheet could be as shown in the following exhibit.

44