Page 67 - Internal Auditing Standards

P. 67

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

Control activities are the policies and procedures that help ensure that management’s directives are

carried out. Examples include controls to ensure that goods are not shipped to a bad credit risk, or that

only authorized purchases are made. These controls address risks that, if not mitigated, would threaten the

achievement of the entity’s objectives.

Control activities (whether within information or manual systems) are designed to mitigate the risks involved

in everyday activities such as transaction processing (business processes such as sales, purchases, and payroll)

and safeguarding of assets.

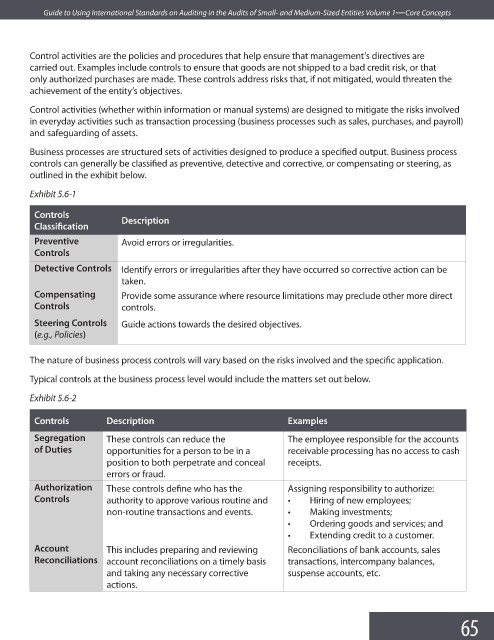

Business processes are structured sets of activities designed to produce a specified output. Business process

controls can generally be classified as preventive, detective and corrective, or compensating or steering, as

outlined in the exhibit below.

Exhibit 5.6-1

Controls Description

Classifi cation

Preventive Avoid errors or irregularities.

Controls

Detective Controls Identify errors or irregularities after they have occurred so corrective action can be

taken.

Compensating Provide some assurance where resource limitations may preclude other more direct

Controls controls.

Steering Controls Guide actions towards the desired objectives.

(e.g., Policies)

The nature of business process controls will vary based on the risks involved and the specifi c application.

Typical controls at the business process level would include the matters set out below.

Exhibit 5.6-2

Controls Description Examples

Segregation These controls can reduce the The employee responsible for the accounts

of Duties opportunities for a person to be in a receivable processing has no access to cash

position to both perpetrate and conceal receipts.

errors or fraud.

Authorization These controls define who has the Assigning responsibility to authorize:

Controls authority to approve various routine and • Hiring of new employees;

non-routine transactions and events. • Making investments;

• Ordering goods and services; and

• Extending credit to a customer.

Account This includes preparing and reviewing Reconciliations of bank accounts, sales

Reconciliations account reconciliations on a timely basis transactions, intercompany balances,

and taking any necessary corrective suspense accounts, etc.

actions.

65