Page 33 - TaxAdviser_2022

P. 33

due date. Taxpayers who cannot pay local contact. (Also see the table “Other Atlanta, GA 30362. Letters requesting

can contact the IRS to request that the Helpful Contact Numbers” on p. 32.) records under FOIA can be short and

account go into currently not collect- simple. A requester who follows the

ible status. The Taxpayer Advocate IRS’s specific procedures may receive a

Service faster response.

The local stakeholder liaison The Taxpayer Advocate Service (TAS) is A FOIA request letter must be

In today’s environment, a practitioner another source of help for practitioners. written and signed by the requester.

must be patient and document all Form 911, Request for Taxpayer Advocate The following elements are required in

contact with the IRS. The practitioner Service Assistance, must be submitted to the letter:

should obtain the name and ID number TAS. Case acceptance criteria take into ■ A statement that the request is being

of all IRS personnel that are contacted consideration economic burden, systemic made under the Freedom of Informa-

and attempt to obtain the name and burden, the best interest of the taxpayer, tion Act.

number of the next level of manager. and public policy. ■ Identification of the records that

The local stakeholder liaison is a good Visit the TAS’s website at are being sought as specifically as

source for practitioners to obtain phone taxpayeradvocate.irs.gov to obtain the possible.

numbers of IRS personnel. fax number of the local taxpayer ad- ■ The name and address of the

A stakeholder liaison establishes vocate office or read Publication 1546, requester.

relationships with practitioners and in- Taxpayers Advocate Service. The toll-free ■ Proof of identity and proof of

dustry organizations representing small number for the TAS is 877-777-4778. the requester’s authority to access

business and self-employed taxpayers. the information if the records are

The liaison provides information about Freedom of Information Act confidential and not available to the

policies, practices, and procedures the guidelines general public (e.g., records subject to

IRS uses to ensure compliance with A Freedom of Information Act (FOIA) the Privacy Act or Sec. 6103).

the tax laws, and elevates issues that request must be in writing and can ■ The requester’s category. The cat-

affect tax administration. To establish a be submitted by faxing the request to egories of requesters are: commercial

relationship with a stakeholder liaison or 877-891-6035 or by mailing it to the In- use, news media, educational or

report an issue, refer to the “Stakeholder ternal Revenue Service, GLDS Support noncommercial scientific institutions,

Liaison Contacts” table below to find a Services, Stop 93A, P.O. Box 621506, and others (including individual).

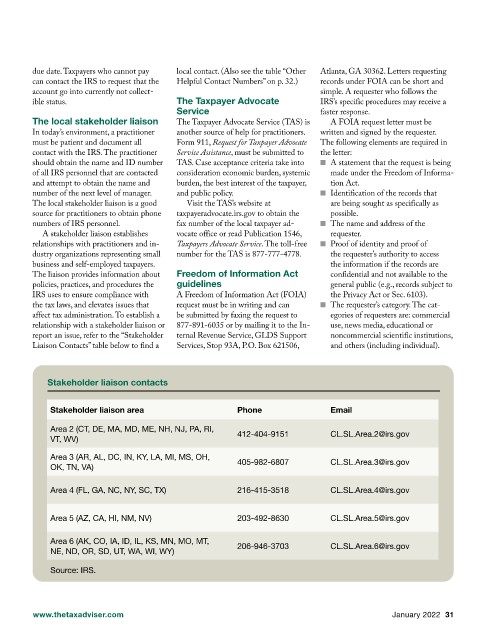

Stakeholder liaison contacts

Stakeholder liaison area Phone Email

Area 2 (CT, DE, MA, MD, ME, NH, NJ, PA, RI, 412-404-9151 CL.SL.Area.2@irs.gov

VT, WV)

Area 3 (AR, AL, DC, IN, KY, LA, MI, MS, OH, 405-982-6807 CL.SL.Area.3@irs.gov

OK, TN, VA)

Area 4 (FL, GA, NC, NY, SC, TX) 216-415-3518 CL.SL.Area.4@irs.gov

Area 5 (AZ, CA, HI, NM, NV) 203-492-8630 CL.SL.Area.5@irs.gov

Area 6 (AK, CO, IA, ID, IL, KS, MN, MO, MT, 206-946-3703 CL.SL.Area.6@irs.gov

NE, ND, OR, SD, UT, WA, WI, WY)

Source: IRS.

www.thetaxadviser.com January 2022 31