Page 34 - TaxAdviser_2022

P. 34

PRACTICE & PROCEDURES

■ An agreement to pay all processing Trust Fund liabilities for persons of address and periods involved], i.e.,

fees for the requested records. An [name of corporation and federal em- for the Form 941 periods ending:

option exists to include an upper ployer identification number (FEIN) 12/31/2017, 6/30/2018, 9/30/2018

limit on the amount the requester and address and all the periods and 12/31/2018.

is willing to pay to complete the involved], i.e., for the Form 941 peri-

request. ods ending: 12/31/2017, 6/30/2018, Be sure to attach powers of attorney

The complete regulatory require- 9/30/2018 and 12/31/2018. for all entities and individual taxpayers

ments for FOIA requests filed with the We request the names of the In- involved in the request.

IRS are available at Regs. Sec. 601.702. ternal Revenue Service Revenue Of-

The FOIA request letter should start ficers or any other Internal Revenue Appeals conferences:

off as follows: Service employee’s case files, notes, Right to access case file

workpapers, administrative file, his- For cases going to Appeals, practitioners

Dear Disclosure Officer: tory sheets including but not limited should generally request the administra-

This is a request under the Free- to notes and records of third-party tive files or access to the nonprivileged

dom of Information Act, 5 U.S.C. contacts, third-party interviews, portions of the case file on record regard-

552 and 26 U.S.C. Section 6103 and a list of third-party contacts, cli- ing the disputed issues (the administra-

IRM Section 11.3.2.4.13. ent interviews, handwritten notes, tive files) through the case file access

We request that a copy of the emails, records created or obtained, procedures (see www.irs.gov/privacy-

following documents in reference time sheets, including but not lim- disclosure/routine-access-to-irs-records).

to [taxpayer] be sent to [practitioner ited to printed or typed documents, This is of vital importance. If the admin-

name and address] as representative tape recordings, maps, photographs, istrative files are of a type not available

of [taxpayer and SSN]. computer printouts, computer tapes through the case file access procedures, or

or disks, or any similar items of the taxpayer does not qualify to use these

FOIA requests relating to trust any IRS employee in reference to procedures, the practitioner should make

fund penalties the Trust Fund Investigation that a FOIA request for the files.

Trust fund penalty disputes are some- determined Trust Fund Liability for Due to COVID-19, Appeals tech-

times intertwined with penalty relief re- persons of [name of entity, FEIN, nical employees have been permitted

quests, OICs, innocent spouse cases, and

other issues. A sample FOIA request in

this context might read in part:

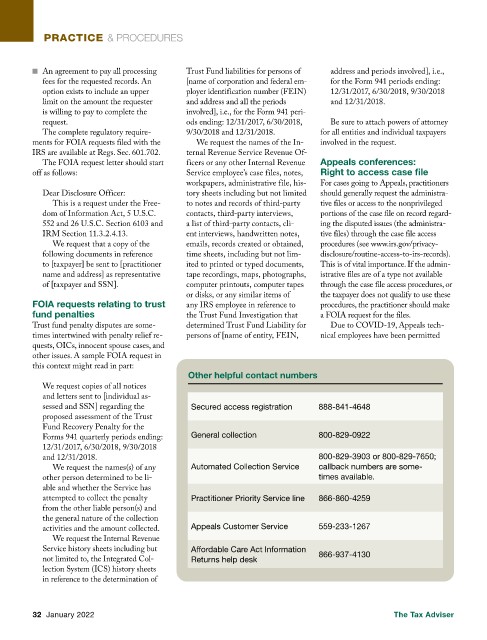

Other helpful contact numbers

We request copies of all notices

and letters sent to [individual as-

sessed and SSN] regarding the Secured access registration 888-841-4648

proposed assessment of the Trust

Fund Recovery Penalty for the

General collection 800-829-0922

Forms 941 quarterly periods ending:

12/31/2017, 6/30/2018, 9/30/2018

and 12/31/2018. 800-829-3903 or 800-829-7650;

We request the names(s) of any Automated Collection Service callback numbers are some-

other person determined to be li- times available.

able and whether the Service has

attempted to collect the penalty Practitioner Priority Service line 866-860-4259

from the other liable person(s) and

the general nature of the collection

Appeals Customer Service 559-233-1267

activities and the amount collected.

We request the Internal Revenue

Service history sheets including but Affordable Care Act Information 866-937-4130

not limited to, the Integrated Col- Returns help desk

lection System (ICS) history sheets

in reference to the determination of

32 January 2022 The Tax Adviser