Page 637 - TaxAdviser_2022

P. 637

EXPENSES & DEDUCTIONS

deductions, so the standard deduction

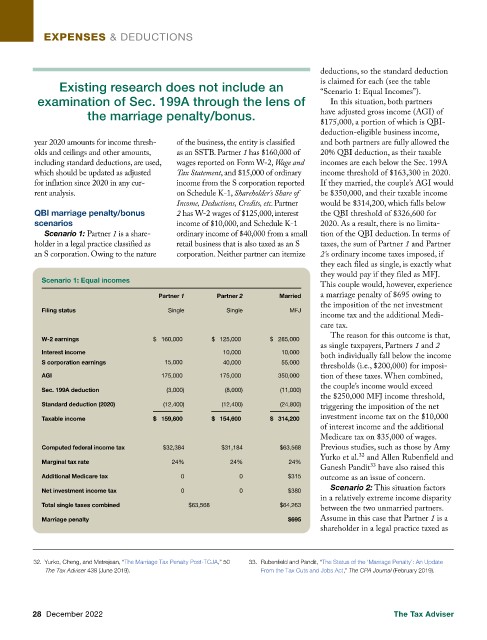

Existing research does not include an is claimed for each (see the table

“Scenario 1: Equal Incomes”).

examination of Sec. 199A through the lens of In this situation, both partners

the marriage penalty/bonus. have adjusted gross income (AGI) of

$175,000, a portion of which is QBI-

deduction-eligible business income,

year 2020 amounts for income thresh- of the business, the entity is classified and both partners are fully allowed the

olds and ceilings and other amounts, as an SSTB. Partner 1 has $160,000 of 20% QBI deduction, as their taxable

including standard deductions, are used, wages reported on Form W-2, Wage and incomes are each below the Sec. 199A

which should be updated as adjusted Tax Statement, and $15,000 of ordinary income threshold of $163,300 in 2020.

for inflation since 2020 in any cur- income from the S corporation reported If they married, the couple’s AGI would

rent analysis. on Schedule K-1, Shareholder's Share of be $350,000, and their taxable income

Income, Deductions, Credits, etc. Partner would be $314,200, which falls below

QBI marriage penalty/bonus 2 has W-2 wages of $125,000, interest the QBI threshold of $326,600 for

scenarios income of $10,000, and Schedule K-1 2020. As a result, there is no limita-

Scenario 1: Partner 1 is a share- ordinary income of $40,000 from a small tion of the QBI deduction. In terms of

holder in a legal practice classified as retail business that is also taxed as an S taxes, the sum of Partner 1 and Partner

an S corporation. Owing to the nature corporation. Neither partner can itemize 2’s ordinary income taxes imposed, if

they each filed as single, is exactly what

they would pay if they filed as MFJ.

Scenario 1: Equal incomes

This couple would, however, experience

Partner 1 Partner 2 Married a marriage penalty of $695 owing to

the imposition of the net investment

Filing status Single Single MFJ

income tax and the additional Medi-

care tax.

W-2 earnings $ 160,000 $ 125,000 $ 285,000 The reason for this outcome is that,

as single taxpayers, Partners 1 and 2

Interest income 10,000 10,000

both individually fall below the income

S corporation earnings 15,000 40,000 55,000

thresholds (i.e., $200,000) for imposi-

AGI 175,000 175,000 350,000 tion of these taxes. When combined,

Sec. 199A deduction (3,000) (8,000) (11,000) the couple’s income would exceed

the $250,000 MFJ income threshold,

Standard deduction (2020) (12,400) (12,400) (24,800) triggering the imposition of the net

Taxable income $ 159,600 $ 154,600 $ 314,200 investment income tax on the $10,000

of interest income and the additional

Medicare tax on $35,000 of wages.

Computed federal income tax $32,384 $31,184 $63,568 Previous studies, such as those by Amy

Yurko et al.³² and Allen Rubenfield and

Marginal tax rate 24% 24% 24%

Ganesh Pandit³³ have also raised this

Additional Medicare tax 0 0 $315 outcome as an issue of concern.

Net investment income tax 0 0 $380 Scenario 2: This situation factors

in a relatively extreme income disparity

Total single taxes combined $63,568 $64,263

between the two unmarried partners.

Marriage penalty $695 Assume in this case that Partner 1 is a

shareholder in a legal practice taxed as

32 Yurko, Cheng, and Metrejean, “The Marriage Tax Penalty Post-TCJA,” 50 33. Rubenfield and Pandit, “The Status of the ‘Marriage Penalty’: An Update

.

The Tax Adviser 438 (June 2019). From the Tax Cuts and Jobs Act,” The CPA Journal (February 2019).

28 December 2022 The Tax Adviser