Page 638 - TaxAdviser_2022

P. 638

an S corporation (an SSTB) and has $24,549 of the $34,149) occurs as a There is also a two-pronged mar-

W-2 wages of $130,000, along with direct result of how the tax rate tables riage penalty because the long-term

Schedule K-1 ordinary income from are configured, with the added tax capital gain from Partner 2, which was

the S corporation of $200,000. Partner savings surfacing because of the Sec. not taxed when filing single, is now

2 has $20,000 of long-term capital gain 199A marriage benefit (i.e., $9,600 of taxed at a rate of 15%. In addition, the

income. Neither partner can itemize, the $34,149). The Sec. 199A marriage married couple would also have to pay

so the standard deduction is claimed benefit arises because Partner 1, when net investment income tax on the long-

for each. filing single, is precluded from taking term gain at a rate of 3.8%. Overall, the

Scenario 2 suggests that, post- a QBI deduction because the income couple in this scenario would still expe-

TCJA, a significant marriage incentive in question is SSTB income and his rience a significant marriage bonus of

continues to exist for couples with or her income exceeds the threshold $30,389, a savings of almost 35.4% (i.e.,

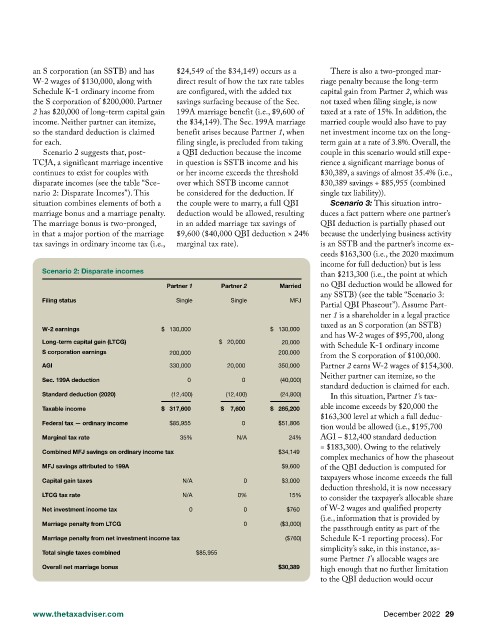

disparate incomes (see the table “Sce- over which SSTB income cannot $30,389 savings ÷ $85,955 (combined

nario 2: Disparate Incomes”). This be considered for the deduction. If single tax liability)).

situation combines elements of both a the couple were to marry, a full QBI Scenario 3: This situation intro-

marriage bonus and a marriage penalty. deduction would be allowed, resulting duces a fact pattern where one partner’s

The marriage bonus is two-pronged, in an added marriage tax savings of QBI deduction is partially phased out

in that a major portion of the marriage $9,600 ($40,000 QBI deduction × 24% because the underlying business activity

tax savings in ordinary income tax (i.e., marginal tax rate). is an SSTB and the partner’s income ex-

ceeds $163,300 (i.e., the 2020 maximum

income for full deduction) but is less

Scenario 2: Disparate incomes

than $213,300 (i.e., the point at which

Partner 1 Partner 2 Married no QBI deduction would be allowed for

any SSTB) (see the table “Scenario 3:

Filing status Single Single MFJ

Partial QBI Phaseout”). Assume Part-

ner 1 is a shareholder in a legal practice

W-2 earnings $ 130,000 $ 130,000 taxed as an S corporation (an SSTB)

and has W-2 wages of $95,700, along

Long-term capital gain (LTCG) $ 20,000 20,000 with Schedule K-1 ordinary income

S corporation earnings 200,000 200,000

from the S corporation of $100,000.

AGI 330,000 20,000 350,000 Partner 2 earns W-2 wages of $154,300.

Sec. 199A deduction 0 0 (40,000) Neither partner can itemize, so the

standard deduction is claimed for each.

Standard deduction (2020) (12,400) (12,400) (24,800) In this situation, Partner 1’s tax-

Taxable income $ 317,600 $ 7,600 $ 285,200 able income exceeds by $20,000 the

$163,300 level at which a full deduc-

Federal tax — ordinary income $85,955 0 $51,806

tion would be allowed (i.e., $195,700

Marginal tax rate 35% N/A 24% AGI – $12,400 standard deduction

= $183,300). Owing to the relatively

Combined MFJ savings on ordinary income tax $34,149

complex mechanics of how the phaseout

MFJ savings attributed to 199A $9,600 of the QBI deduction is computed for

Capital gain taxes N/A 0 $3,000 taxpayers whose income exceeds the full

deduction threshold, it is now necessary

LTCG tax rate N/A 0% 15%

to consider the taxpayer’s allocable share

Net investment income tax 0 0 $760 of W-2 wages and qualified property

(i.e., information that is provided by

Marriage penalty from LTCG 0 ($3,000)

the passthrough entity as part of the

Marriage penalty from net investment income tax ($760) Schedule K-1 reporting process). For

Total single taxes combined $85,955 simplicity’s sake, in this instance, as-

sume Partner 1’s allocable wages are

Overall net marriage bonus $30,389 high enough that no further limitation

to the QBI deduction would occur

www.thetaxadviser.com December 2022 29