Page 31 - Finanancial Management_2022

P. 31

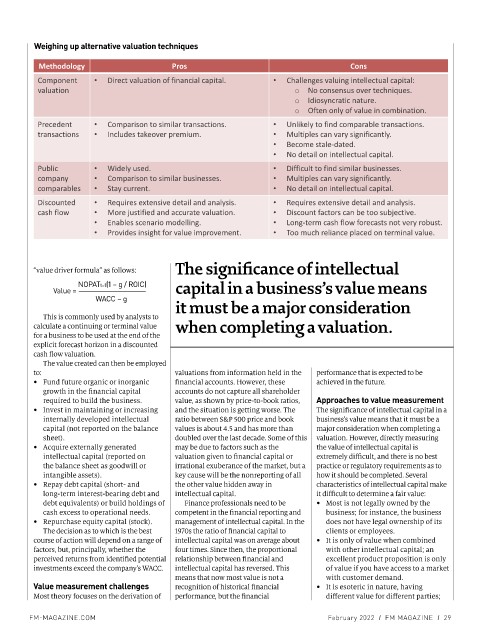

Weighing up alternative valuation techniques

Methodology Pros Cons

Component • Direct valuation of financial capital. • Challenges valuing intellectual capital:

valuation o No consensus over techniques.

o Idiosyncratic nature.

o Often only of value in combination.

Precedent • Comparison to similar transactions. • Unlikely to find comparable transactions.

transactions • Includes takeover premium. • Multiples can vary significantly.

• Become stale-dated.

• No detail on intellectual capital.

Public • Widely used. • Difficult to find similar businesses.

company • Comparison to similar businesses. • Multiples can vary significantly.

comparables • Stay current. • No detail on intellectual capital.

Discounted • Requires extensive detail and analysis. • Requires extensive detail and analysis.

cash flow • More justified and accurate valuation. • Discount factors can be too subjective.

• Enables scenario modelling. • Long-term cash flow forecasts not very robust.

• Provides insight for value improvement. • Too much reliance placed on terminal value.

Figure 2: Weighing up alternative valuation techniques

The significance of intellectual

“value driver formula” as follows:

NOPATt=1(1 – g / ROIC) capital in a business’s value means

Value =

WACC – g

it must be a major consideration

This is commonly used by analysts to

calculate a continuing or terminal value when completing a valuation.

for a business to be used at the end of the

explicit forecast horizon in a discounted

cash flow valuation.

The value created can then be employed

to: valuations from information held in the performance that is expected to be

y Fund future organic or inorganic financial accounts. However, these achieved in the future.

growth in the financial capital accounts do not capture all shareholder

required to build the business. value, as shown by price-to-book ratios, Approaches to value measurement

y Invest in maintaining or increasing and the situation is getting worse. The The significance of intellectual capital in a

internally developed intellectual ratio between S&P 500 price and book business’s value means that it must be a

capital (not reported on the balance values is about 4.5 and has more than major consideration when completing a

sheet). doubled over the last decade. Some of this valuation. However, directly measuring

y Acquire externally generated may be due to factors such as the the value of intellectual capital is

intellectual capital (reported on valuation given to financial capital or extremely difficult, and there is no best

the balance sheet as goodwill or irrational exuberance of the market, but a practice or regulatory requirements as to

intangible assets). key cause will be the nonreporting of all how it should be completed. Several

y Repay debt capital (short- and the other value hidden away in characteristics of intellectual capital make

long-term interest-bearing debt and intellectual capital. it difficult to determine a fair value:

debt equivalents) or build holdings of Finance professionals need to be y Most is not legally owned by the

cash excess to operational needs. competent in the financial reporting and business; for instance, the business

y Repurchase equity capital (stock). management of intellectual capital. In the does not have legal ownership of its

The decision as to which is the best 1970s the ratio of financial capital to clients or employees.

course of action will depend on a range of intellectual capital was on average about y It is only of value when combined

factors, but, principally, whether the four times. Since then, the proportional with other intellectual capital; an

perceived returns from identified potential relationship between financial and excellent product proposition is only

investments exceed the company’s WACC. intellectual capital has reversed. This of value if you have access to a market

means that now most value is not a with customer demand.

Value measurement challenges recognition of historical financial y It is esoteric in nature, having

Most theory focuses on the derivation of performance, but the financial different value for different parties;

FM-MAGAZINE.COM February 2022 I FM MAGAZINE I 29