Page 32 - Finanancial Management_2022

P. 32

Finance professionals need to be based on the historic or forecast values

of various financial profit (net income or

competent in the financial EBITDA) or cash flow (free cash flow for

firm (FCFF), free cash flow for equity

reporting and management of (FCFE), or cash from operations)

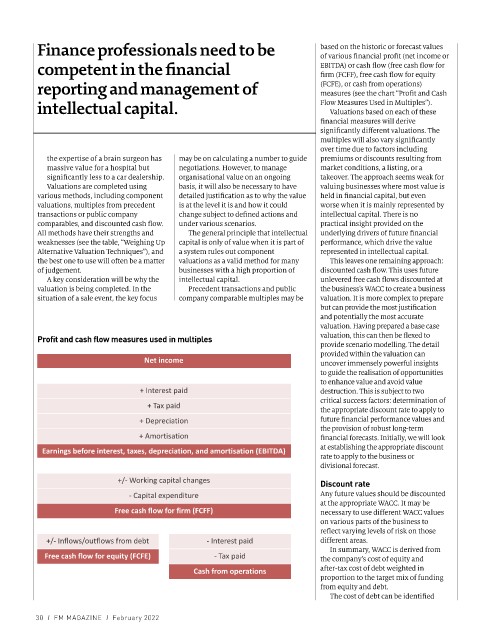

measures (see the chart “Profit and Cash

intellectual capital. Flow Measures Used in Multiples”).

Valuations based on each of these

financial measures will derive

significantly different valuations. The

multiples will also vary significantly

over time due to factors including

the expertise of a brain surgeon has may be on calculating a number to guide premiums or discounts resulting from

massive value for a hospital but negotiations. However, to manage market conditions, a listing, or a

significantly less to a car dealership. organisational value on an ongoing takeover. The approach seems weak for

Valuations are completed using basis, it will also be necessary to have valuing businesses where most value is

various methods, including component detailed justification as to why the value held in financial capital, but even

valuations, multiples from precedent is at the level it is and how it could worse when it is mainly represented by

transactions or public company change subject to defined actions and intellectual capital. There is no

comparables, and discounted cash flow. under various scenarios. practical insight provided on the

All methods have their strengths and The general principle that intellectual underlying drivers of future financial

weaknesses (see the table, “Weighing Up capital is only of value when it is part of performance, which drive the value

Alternative Valuation Techniques”), and a system rules out component represented in intellectual capital.

the best one to use will often be a matter valuations as a valid method for many This leaves one remaining approach:

of judgement. businesses with a high proportion of discounted cash flow. This uses future

A key consideration will be why the intellectual capital. unlevered free cash flows discounted at

valuation is being completed. In the Precedent transactions and public the business’s WACC to create a business

situation of a sale event, the key focus company comparable multiples may be valuation. It is more complex to prepare

but can provide the most justification

and potentially the most accurate

valuation. Having prepared a base case

Profit and cash flow measures used in multiples valuation, this can then be flexed to

provide scenario modelling. The detail

provided within the valuation can

Net income uncover immensely powerful insights

to guide the realisation of opportunities

to enhance value and avoid value

+ Interest paid destruction. This is subject to two

+ Tax paid critical success factors: determination of

the appropriate discount rate to apply to

+ Depreciation future financial performance values and

the provision of robust long-term

+ Amortisation financial forecasts. Initially, we will look

Earnings before interest, taxes, depreciation, and amortisation (EBITDA) at establishing the appropriate discount

rate to apply to the business or

divisional forecast.

+/- Working capital changes Discount rate

- Capital expenditure Any future values should be discounted

at the appropriate WACC. It may be

Free cash flow for firm (FCFF) necessary to use different WACC values

on various parts of the business to

reflect varying levels of risk on those

+/- Inflows/outflows from debt - Interest paid different areas.

In summary, WACC is derived from

Free cash flow for equity (FCFE) - Tax paid the company’s cost of equity and

Cash from operations after-tax cost of debt weighted in

proportion to the target mix of funding

from equity and debt.

Figure 3: Profit and cash flow measures used in multiples The cost of debt can be identified

30 I FM MAGAZINE I February 2022