Page 33 - Finanancial Management_2022

P. 33

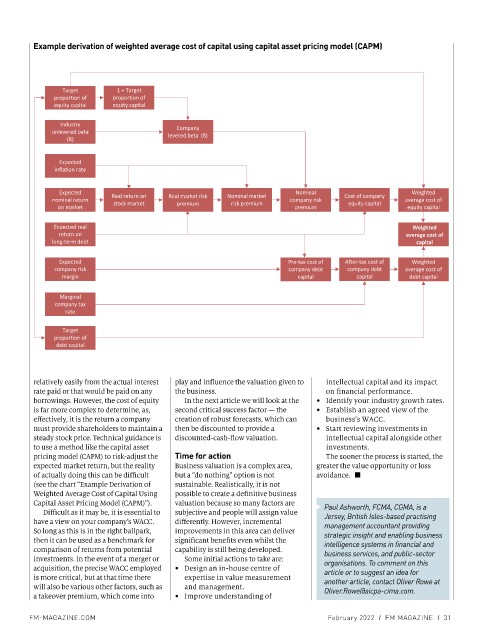

Example derivation of weighted average cost of capital using capital asset pricing model (CAPM)

Target 1 ÷ Target

proportion of proportion of

equity capital equity capital

Industry Company

unlevered beta levered beta (ß)

(ß)

Expected

inflation rate

Expected Nominal Weighted

nominal return Real return on Real market risk Nominal market company risk Cost of company average cost of

stock market

risk premium

equity capital

on market premium premium equity capital

Expected real Weighted

return on average cost of

long-term debt capital

Expected Pre-tax cost of After-tax cost of Weighted

company risk company debt company debt average cost of

margin capital capital debt capital

Marginal

company tax

rate

Target

proportion of

debt capital

Figure 4: Example derivation of weighted average cost of capital using capital asset pricing model (CAPM)

relatively easily from the actual interest play and influence the valuation given to intellectual capital and its impact

rate paid or that would be paid on any the business. on financial performance.

borrowings. However, the cost of equity In the next article we will look at the y Identify your industry growth rates.

is far more complex to determine, as, second critical success factor — the y Establish an agreed view of the

effectively, it is the return a company creation of robust forecasts, which can business’s WACC.

must provide shareholders to maintain a then be discounted to provide a y Start reviewing investments in

steady stock price. Technical guidance is discounted-cash-flow valuation. intellectual capital alongside other

to use a method like the capital asset investments.

pricing model (CAPM) to risk-adjust the Time for action The sooner the process is started, the

expected market return, but the reality Business valuation is a complex area, greater the value opportunity or loss

of actually doing this can be difficult but a “do nothing” option is not avoidance. ■

(see the chart “Example Derivation of sustainable. Realistically, it is not

Weighted Average Cost of Capital Using possible to create a definitive business

Capital Asset Pricing Model (CAPM)”). valuation because so many factors are Paul Ashworth, FCMA, CGMA, is a

Difficult as it may be, it is essential to subjective and people will assign value Jersey, British Isles-based practising

have a view on your company’s WACC. differently. However, incremental management accountant providing

So long as this is in the right ballpark, improvements in this area can deliver strategic insight and enabling business

then it can be used as a benchmark for significant benefits even whilst the intelligence systems in financial and

comparison of returns from potential capability is still being developed. business services, and public-sector

investments. In the event of a merger or Some initial actions to take are: organisations. To comment on this

acquisition, the precise WACC employed y Design an in-house centre of article or to suggest an idea for

is more critical, but at that time there expertise in value measurement another article, contact Oliver Rowe at

will also be various other factors, such as and management. Oliver.Rowe@aicpa-cima.com.

a takeover premium, which come into y Improve understanding of

FM-MAGAZINE.COM February 2022 I FM MAGAZINE I 31