Page 51 - Finanancial Management_2022

P. 51

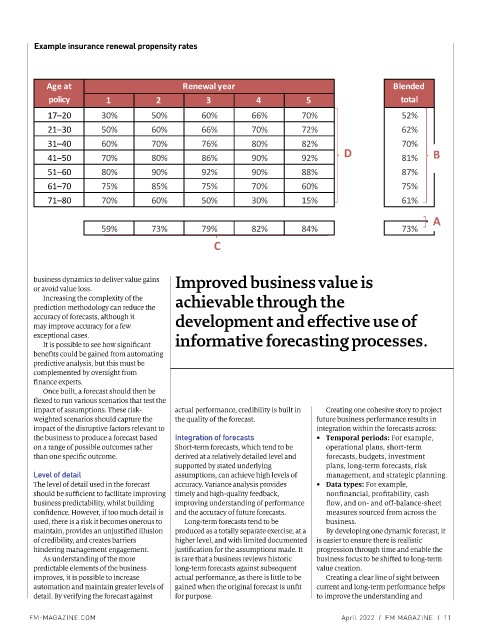

Example insurance renewal propensity rates

Age at Renewal year Blended

policy 1 2 3 4 5 total

inception 30% 50% 60% 66% 70% 52%

17–20

21–30 50% 60% 66% 70% 72% 62%

31–40 60% 70% 76% 80% 82% 70%

41–50 70% 80% 86% 90% 92% D 81% B

51–60 80% 90% 92% 90% 88% 87%

61–70 75% 85% 75% 70% 60% 75%

71–80 70% 60% 50% 30% 15% 61%

A

59% 73% 79% 82% 84% 73%

C

Example insurance renewal propensity rates

business dynamics to deliver value gains Improved business value is

or avoid value loss.

Increasing the complexity of the achievable through the

prediction methodology can reduce the

accuracy of forecasts, although it development and effective use of

may improve accuracy for a few

exceptional cases. informative forecasting processes.

It is possible to see how significant

benefits could be gained from automating

predictive analysis, but this must be

complemented by oversight from

finance experts.

Once built, a forecast should then be

flexed to run various scenarios that test the

impact of assumptions. These risk- actual performance, credibility is built in Creating one cohesive story to project

weighted scenarios should capture the the quality of the forecast. future business performance results in

impact of the disruptive factors relevant to integration within the forecasts across:

the business to produce a forecast based Integration of forecasts y Temporal periods: For example,

on a range of possible outcomes rather Short-term forecasts, which tend to be operational plans, short-term

than one specific outcome. derived at a relatively detailed level and forecasts, budgets, investment

supported by stated underlying plans, long-term forecasts, risk

Level of detail assumptions, can achieve high levels of management, and strategic planning.

The level of detail used in the forecast accuracy. Variance analysis provides y Data types: For example,

should be sufficient to facilitate improving timely and high-quality feedback, nonfinancial, profitability, cash

business predictability, whilst building improving understanding of performance flow, and on- and off-balance-sheet

confidence. However, if too much detail is and the accuracy of future forecasts. measures sourced from across the

used, there is a risk it becomes onerous to Long-term forecasts tend to be business.

maintain, provides an unjustified illusion produced as a totally separate exercise, at a By developing one dynamic forecast, it

of credibility, and creates barriers higher level, and with limited documented is easier to ensure there is realistic

hindering management engagement. justification for the assumptions made. It progression through time and enable the

As understanding of the more is rare that a business reviews historic business focus to be shifted to long-term

predictable elements of the business long-term forecasts against subsequent value creation.

improves, it is possible to increase actual performance, as there is little to be Creating a clear line of sight between

automation and maintain greater levels of gained when the original forecast is unfit current and long-term performance helps

detail. By verifying the forecast against for purpose. to improve the understanding and

FM-MAGAZINE.COM April 2022 I FM MAGAZINE I 11