Page 206 - TaxAdviser_Jan_Apr23_Neat

P. 206

TAX CLINIC

purchase accounting rules, the $600 In contrast, a company with the alternative on their valuation allowance

million of goodwill is all Component same fact pattern — except that it assessments. While it is tempting to rely

1 goodwill. The company has elected was unable to or did not elect to use on mechanical triggers, such as using

the private company alternative and the private company alternative for evidence of cumulative book losses as a

will amortize the book goodwill over goodwill — would be in a cumulative bright-line test, the guidance in ASC

10 years ($60 million per year) and income position and have a DTL as Topic 740 is clear that companies must

the tax goodwill over 15 years ($40 a result of the tax amortization of the use professional judgment in evaluating

million per year). As a result of the goodwill. Both companies would have all of the positive and negative evidence

election to amortize book goodwill, the same amount of taxable income in available to conclude whether it is

the company will have a $60 million this scenario. more likely than not that the company

amortization expense in the finan- Over the past few years, FASB will realize its DTAs. While objective

cials that is a significant component has explored the idea of amortizing evidence should certainly be given more

of the pretax book losses. However, goodwill for public companies because weight in assessing the need for a valu-

due to the 15-year tax life of the of the cost and complexity of perform- ation allowance, ultimately, there is no

goodwill, the company has taxable ing goodwill impairment testing. alternative to professional judgment.

income over the same three-year After various roundtable discussions This is particularly critical in situations

period as shown in the table, “Re- with stakeholders and research efforts, as outlined above, where an accounting

sults of Election to Amortize Book FASB deprioritized and ultimately election could have a significant impact

Goodwill.” removed the project from the techni- on the analysis and outcome.

cal agenda. Companies that began From Al Cappelloni, CPA

As of Dec. 31, 2022, the company has amortizing goodwill after the TCJA’s (Al.Cappelloni@rsmus.com), Boston;

a cumulative deductible temporary dif- enactment, when NOLs have indefinite Darian Harnish, CPA (Darian.Harnish

ference of $60 million that would reverse lives, would likely not have experienced @rsmus.com), Washington, D.C.; and

in years 11–15 after the book goodwill is a significant one-time benefit from the Austin Rice, CPA (Austin.Rice@rsmus

fully amortized. Assuming the company release of the valuation allowance from .com), Raleigh, N.C.

can accurately forecast and its future the conversion of the indefinite-lived

results are expected to be consistent with DTLs to definite-lived DTLs. How- Improve a business’s

historical financial results, the analysis ever, as goodwill is amortized, there fixed-asset management with

of future taxable income suggests that would still be an effect on cumulative technology

the company will be able to realize book earnings. Although many high-performing

the DTAs resulting from the goodwill While public companies may not companies have figured out how to

amortization difference. If the company be amortizing book goodwill anytime manage the tax and financial accounting

stopped with the three-year cumula- soon, private companies preparing necessary for fixed and intangible assets,

tive book loss to determine whether a financial statements should carefully most still rely on older technology for

valuation allowance was necessary, the consider the effect of their accounting this. Companies should be commended

analysis would be incomplete. policies under the private company for taking time to build processes that

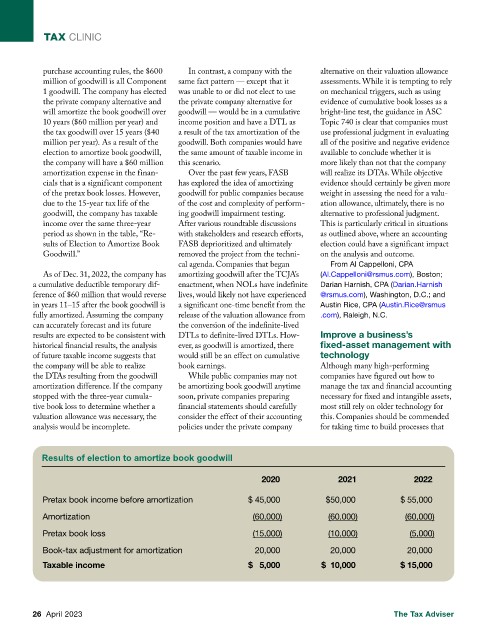

Results of election to amortize book goodwill

2020 2021 2022

Pretax book income before amortization $ 45,000 $50,000 $ 55,000

Amortization (60,000) (60,000) (60,000)

Pretax book loss (15,000) (10,000) (5,000)

Book-tax adjustment for amortization 20,000 20,000 20,000

Taxable income $ 5,000 $ 10,000 $ 15,000

26 April 2023 The Tax Adviser