Page 192 - International Taxation IRS Training Guides

P. 192

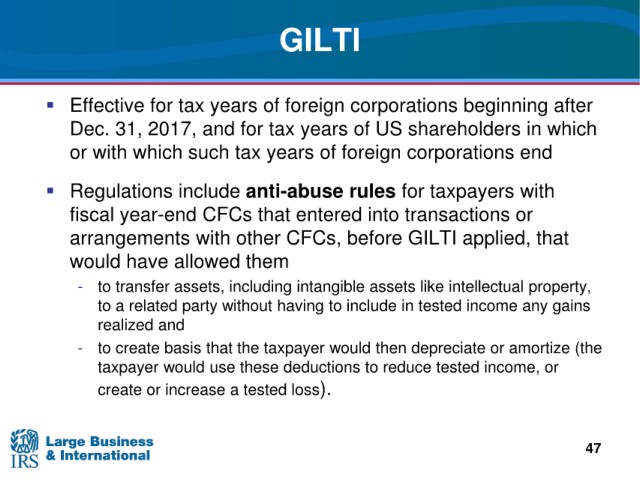

GILTI

tax years of foreign corporations beginning after

Effective for

tax years of US shareholders in which

Dec. 31, 2017, and for

with which such tax years of foreign corporations end

or

with

Regulations include anti-abuse rules for taxpayers

fiscal year-end CFCs

that entered into transactions or

arrangements

with other CFCs, before GILTI applied, that

would have allowed them

- to transfer assets, including intangible assets like intellectual property,

to a related party without having to include in tested income any gains

realized and

- to create basis

that the taxpayer would then depreciate or amortize (the

would use these deductions to reduce tested income, or

taxpayer

create or increase a tested loss).

47