Page 195 - International Taxation IRS Training Guides

P. 195

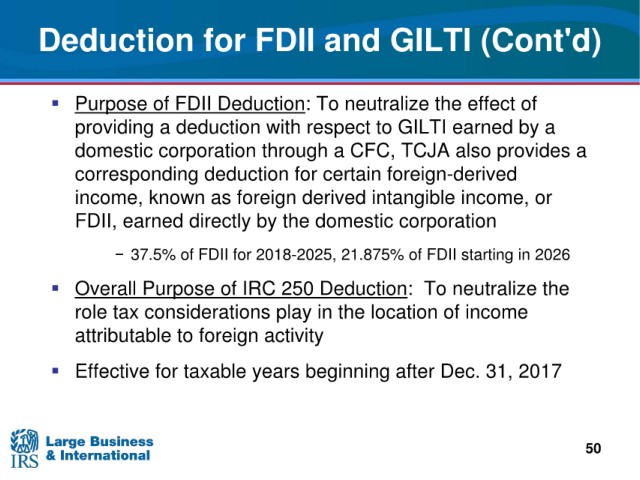

Deduction for

FDII and GILTI (Cont'd)

Purpose of FDII Deduction: To neutralize the effect of

providing a deduction with respect to GILTI earned by a

domestic

corporation through a CFC, TCJA also provides a

corresponding deduction for certain foreign-derived

income, known as foreign derived intangible income, or

FDII, earned directly

by the domestic corporation

FDII for 2018-2025, 21.875% of FDII starting in 2026

− 37.5% of

Overall Purpose of IRC 250 Deduction: To neutralize the

role tax

considerations play in the location of income

attributable to foreign activity

Effective for taxable years beginning after Dec. 31, 2017

50