Page 196 - International Taxation IRS Training Guides

P. 196

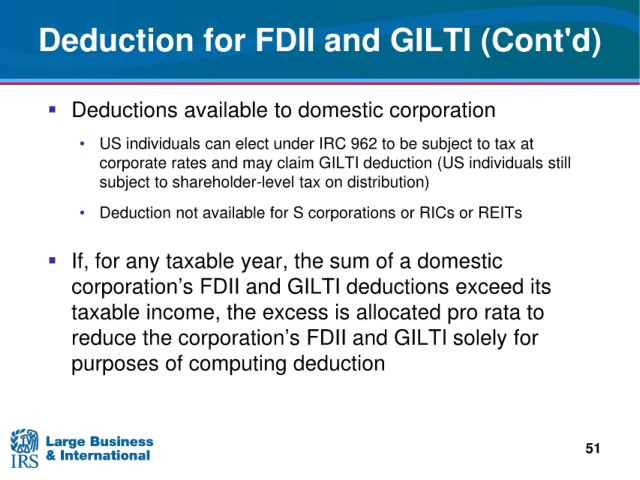

Deduction for

FDII and GILTI (Cont'd)

available to domestic corporation

Deductions

• US individuals

can elect under IRC 962 to be subject to tax at

corporate rates and may

claim GILTI deduction (US individuals still

to shareholder-level tax on distribution)

subject

corporations or RICs or REITs

• Deduction not available for S

If,

for any taxable year, the sum of a domestic

corporation’s FDII

and GILTI deductions exceed its

taxable income, the excess

is allocated pro rata to

reduce the corporation’s

FDII and GILTI solely for

purposes of

computing deduction

51