Page 103 - Arthyog_FilBook_05 05 2024 (1)

P. 103

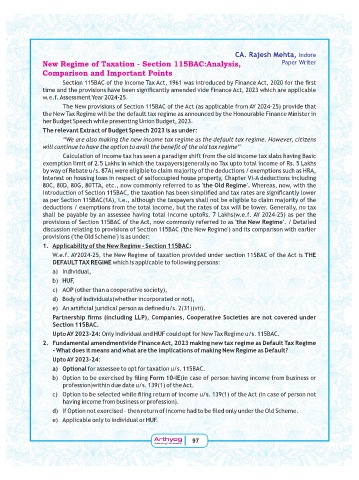

CA. Rajesh Mehta, (

New Regime of Taxation - Section 115BAC:Analysis, & 7

Comparison and Important Points

, +) . ( ! / + R 1 < + =$=$ . ?

! & " " % ? ! " < + =$=- 1 &&

1 . + ! T =$= ;=,

1 & " . , +) . + ' && . ! +T =$= ;=,* & "

1 / % ! 1 . / % ! 8 <

% & 1 & % B % =$=-

The relevant Extract of Budget Speech 2023 is as under:

“We are also making the new income tax regime as the default tax regime. However, citizens

will continue to have the option to avail the benefit of the old tax regime”

) . ! / & %! . . ! ! / " %

/ !& ! . = , 0 1 /& '% / & ! . , 0

1 . I # +* 1 % ! ! @ . I / !& 8 +

( % & . . & & & ) & 5(;+ %

#$) #$A #$4 #$ + 1 !! . 'the Old Regime' 7 1 1

. , +) / !& ? / % ? 1

& , +)' +* % /& % ! ! @ .

I / !& . ! ! . / 1 1 4 /

& " % ! & 0 '1 . +T =$= ;=,* &

& " . , +) . + 1 !! . 'the New Regime' I A

% & " . , +) 'C 1 % ! C* !& 1

& " 'C E ! C* G

1. Applicability of the New Regime - Section 115BAC:

7 . +T=$= ;=, 1 % ! . / & " , +) . + THE

DEFAULT TAX REGIME 1 && . 1 % & G

* ( "

* 8B<

* +E ' & " *

* . ( " '1 & *

* + ? @ & ? I ='- *'" *

Partnership firms (including LLP), Companies, Cooperative Societies are not covered under

Section 115BAC.

Upto AY 2023-24: E ( " 8B< & . 1 / % ! I , +)

2. Fundamental amendmentvide Finance Act, 2023 making new tax regime as Default Tax Regime

– What does it means and what are the implications of making New Regime as Default?

Upto AY 2023-24G

a) Optional . & . / I , +)

* E& / ? % Form 10-IE' . & " % ! . !

& . *1 I - ' * . +

* E& 1 ? % . ! I - ' * . + ' . &

" % ! . ! & . *

* (. E& / 3 . ! ? E !

* +&& ( " 8B<

97