Page 107 - Arthyog_FilBook_05 05 2024 (1)

P. 107

% 9 ! + 1 " 4 " ! 9!& ] R' *^

. / !& ] R' *^

( 1 & & . . & & & ? =-'=*

] = ' *^

@ + A & ] -=' *' *^

& ? I 1 ] -=+A --+ --+ +

-,' *' *I' *I' * -,'=++* -,+A -,)))^

) & 5(;+ 1 1 / % ! ]9/ & #$))A'=*

9!& ) & Y . . ) 4 " ! 9!&

$Y . . E 9!& #$))8'=* #$ ++ .

!& 1 1 1 / % ! ^

+ & , +)'=*' *' *3 % < 1 0 A & 3 . & %

. , +)'=*' *' + A & " !

1 * ! 1 D

. ! ! !& 1 , +)

< & , +)'=*' *' * 30 . ! & & 1

; D % . !

, +)'=*' "* ; 9/ !& . 1 & : 1 " !

& " 1 . ! % . "

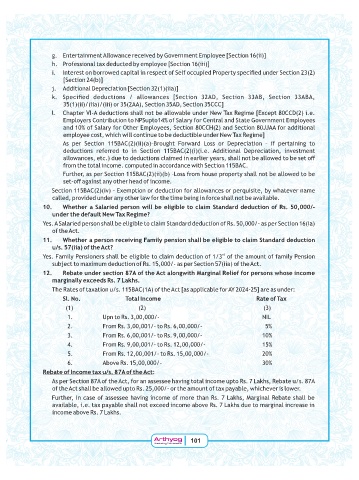

10. Whether a Salaried person will be eligible to claim Standard deduction of Rs. 50,000/-

under the default New Tax Regime?

T + & % ! . ,$ $$$I; & R' *

. +

11. Whether a person receiving Family pension shall be eligible to claim Standard deduction

u/s. 57(iia) of the Act?

T < ! % ! . I- . ! . . !

@ ! / ! ! . , $$$I; & , ' * . +

12. Rebate under section 87A of the Act alongwith Marginal Relief for persons whose income

marginally exceeds Rs. 7 Lakhs.

. / I , +)' +* . + ] && . +T =$= ;=,^ G

Sl. No. Total Income Rate of Tax

' * '=* '-*

B& - $$ $$$I; (0

= < ! - $$ $$ I; R $$ $$$I; ,Y

- < ! R $$ $$ I; $$ $$$I; $Y

< ! $$ $$ I; = $$ $$$I; ,Y

, < ! = $$ $$ I; , $$ $$$I; =$Y

R + " , $$ $$$I; -$Y

Rebate of Income tax u/s. 87A of the Act:

+ & # + . + . " % ! & 0 I # +

. + 1 & =, $$$I; ! . / & 1 " 1

< . " % ! . ! 0 %

" / & / ! " 0 ! %

! " 0

101